A solid first quarter for stocks

Global stocks continued to perform well in the first quarter of 2017. The post-election momentum in the stock market persisted into the post-inauguration phase as well. U.S. stocks rose by about 6% and foreign stocks gained even more. Large company stocks performed better than smaller ones and stocks with more sustainable growth attributes outperformed the more economically sensitive value stocks. Bonds were up by about 1% as interest rates eased back from their highs of early 2017.

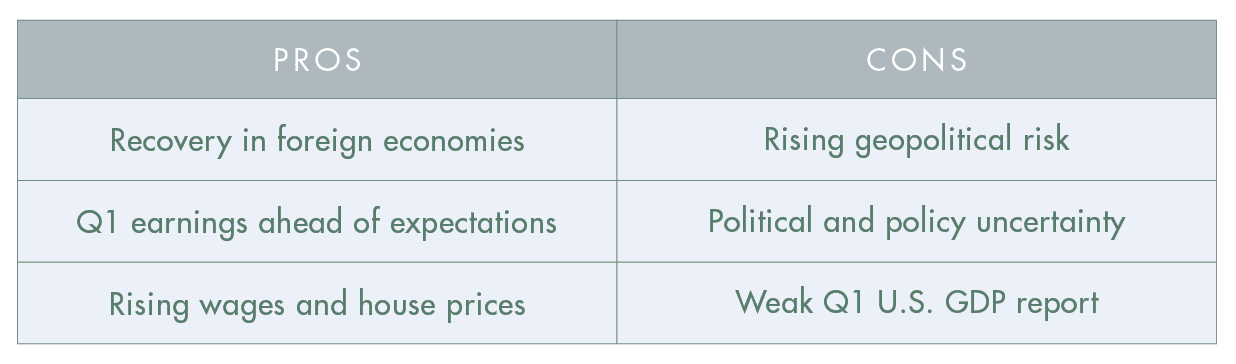

The markets have proved remarkably resilient to a number of headwinds that have emerged recently. Geopolitical risks have risen, the new administration suffered political setbacks even as the future policy agenda remains uncertain and the initial first quarter GDP report was distinctly weak. We also see several fundamental positives that seek to restore balance in favor of stocks. Growth outside the U.S. continues to recover, first quarter earnings are coming in above expectations and wages and house prices continue to rise.

We address these topics in greater detail and observe that markets in the long term are more influenced by economic fundamentals and less so by geopolitical issues.

While a lot of uncertainty prevails on the political and policy fronts, we are encouraged at this point by the fundamental improvements in the growth outlook.

Rising Geopolitical Concerns

Concerns about sectarian terrorist threats, Syria’s authoritarian regime and North Korea’s nuclear aspirations began to rise toward the end of the first quarter. They escalated in earnest during April as the U.S. reacted decisively to what it believed were acts of unwarranted aggression and provocation. The new administration adopted a tough stance on several fronts – air strikes in Syria in response to reports of a domestic chemical gas attack, military action in Afghanistan against terrorism and threats of military engagement and economic sanctions against North Korea’s renewed weapons initiatives. U.S. stocks declined by almost 3% from their previous peak in the face of heightened geopolitical tensions.

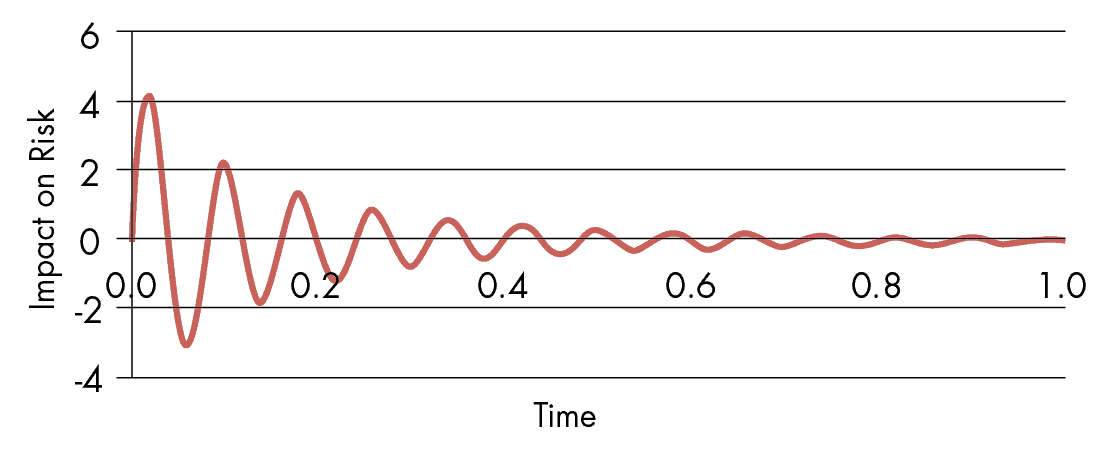

We understand that geopolitical risks have the potential to be unnerving and outright scary, especially in the context of worst-case scenarios. The dramatic and incessant media coverage often plays to our basic human emotions of empathy, grief, and fear. We believe, however, that the long-term economic consequences of these geopolitical risks are likely to be muted. The response function in terms of the impact on perceived and realized risk tends to be as shown below. It is usually high at the outset and generally subsides over time. Since the end of the Global Financial Crisis in 2009, we have seen this play out with a number of geopolitical events – Grexit and Brexit, the annexation of Crimea, Russia-Ukraine conflicts and perennial tensions in the Middle East.

We recognize that on rare occasions these risks can spill over into the real economy or disrupt the financial system. We are vigilant to the potential of spill-over effects, such as sharp declines in global economic activity, liquidity shocks or disruptions to oil prices.

The First 100 Days

The early scorecard for the new administration shows mixed results. While a number of executive orders have been signed, there has been little progress on the policy front overall. The first major policy initiative undertaken by the new President, the repeal and replacement of the Affordable Care Act, met with resistance within his own political party and eventually failed to come to a vote. After an initial negative reaction, markets have since taken the outcome in stride to focus on other policy issues such as tax reform and deregulation.

The new administration has recently unveiled a skeletal framework for tax reform. The proposals call for a lower corporate tax rate, lower personal income tax rates, fewer personal tax brackets, a simplified tax code in terms of permissible deductions and favorable tax treatment for repatriated earnings. While the tax reform proponents have thus far been short on funding details, they generally argue that higher government revenues from renewed economic growth will be a sufficient offset.

We recognize that the progress towards fiscal stimulus from tax reform and higher spending has been slow to evolve and may take longer than initially expected. It may even be less in magnitude than originally anticipated in light of the current deficit levels.

We believe, however, that the markets may be less dependent on the future U.S. policy agenda and may instead draw support from the synchronized and organic recovery in global growth which began well before the elections even took place.

Is The Economy Healthy?

We begin our discussion on the topic by first addressing the weak U.S. Q1 GDP report. The initial official measure of first quarter GDP growth in the U.S. came in at 0.7%. The lackluster growth was attributed to mediocre consumer spending, which in turn was exacerbated by a big decline in vehicle sales.

Weather fluctuations and calendar quirks are commonly held out to explain such shortfalls. We, however, analyze this new economic information from a couple of other perspectives. First, as we have written before, this last report continues an interesting trend where Q1 GDP growth is consistently and meaningfully lower than the growth reported in the other 3 quarters. We then note that weakness in consumer spending was offset by unexpected strength in both residential and non-residential investment. We are mindful of the gap between hard data, such as consumer spending, and soft data, such as sky-high consumer confidence readings. We believe, however, that a number of positive factors bode well for a rebound in growth in the second quarter and second half of 2017.

The U.S. consumer is likely to benefit from continued improvements on several fronts. Growth in average hourly earnings has risen steadily from 2% to almost 3%. The low levels of unemployment make it likely that this trend of higher wages will continue. The U.S. housing market remains quite robust. House prices, housing starts, household formation and homeownership rates have all shown steady gains over the last several months.

We have observed in the past that economies outside the U.S. are simultaneously experiencing a revival of growth. With a stable U.S. dollar in recent months, the strength in foreign economies augurs well for the manufacturing sector. Overseas growth is likely to be sustained as monetary policy abroad remains significantly accommodative. Global short rates are close to all-time lows and several foreign central banks remain engaged in bond purchases to keep rates low.

In a potential precursor for a rebound in growth, the Atlanta Fed published its first estimate for Q2 GDP growth at 4.3%. While prone to some forecasting error, we believe it offers a useful guide to the likely direction of economic activity in the coming months.

We close out our discussion on growth dynamics by switching from economic growth to earnings growth. The recent earnings recession in the U.S. lasted for 5 quarters and likely ended in the third quarter of 2016. Year-over-year earnings growth in each subsequent quarter has been steadily higher and was estimated to be in excess of 12% for Q1 2017 at the end of April. More than half of the S&P 500 companies have reported earnings and the majority have exceeded expectations. If this pace is sustained over the rest of the earnings season, it will be the highest rate of earnings growth since 2011.

The improvement in earnings is not surprising. The two factors that contributed to the earnings recession were a stronger dollar and weaker oil prices. Both of those trends have been firmly reversed – to the point where they now act as tailwinds instead of headwinds. As evidence for this likely effect, companies with high foreign sales are reporting higher earnings growth in Q1 than their domestic counterparts. At this point, we believe that the U.S. and global economies are reasonably healthy. We see enough fundamental strength to assign a low probability to an impending recession in the near term.

Summary

Investor sentiment remains divided between those who view the glass as half empty and those who see it as half full. Valuation concerns have persisted for several months now and recent hard economic data and future policy initiatives in the U.S. appear to have fallen short of expectations.

We are encouraged that the equity markets may well be supported here by the positive momentum of rising revenues and earnings, a strengthening labor market, rising wages, strong demand for housing, improving foreign economies, the potential for fiscal stimulus, continued accommodative monetary policy around the world, low inflation and low-interest rates.

We are mindful of the myriad risks that may yet derail this bull market. We remain vigilant to those possibilities and believe that our emphasis on high-quality investments will stand us in good stead going forward.

SOURCE: Earnings data from FactSet

Investment and Wealth Management Services are provided by Whittier Trust Company and The Whittier Trust Company of Nevada, Inc. (referred to herein individually and collectively as “Whittier Trust”), state-chartered trust companies wholly owned by Whittier Holdings, Inc. (“WHI”), a closely held holding company. WHI may utilize the services of its subsidiary, Belridge Capital, LLC, a state registered investment advisor, to provide sub-advisory services for certain accounts and proprietary private fund investments.

This paper is provided for informational purposes only. The views expressed by Whittier Trust’s Chief Investment Officer are as of a particular point in time and are subject to change without notice. The information and opinions presented herein have been obtained from, or are based on, sources believed by Whittier Trust to be reliable, but Whittier Trust makes no representation as to their accuracy or completeness. Actual events or results may differ materially from those reflected or contemplated herein. Although the information provided is carefully reviewed, Whittier Trust cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided. Company references are provided for illustrative purposes only and should not be construed as investment advice or a recommendation to purchase, sell or hold any security. Past performance is no guarantee of future results and no investment strategy can guarantee profit or protection against losses. These materials may not be reproduced or distributed without Whittier Trust’s prior written consent.

“While a lot of uncertainty prevails on the political and policy fronts, we are encouraged at this point by the fundamental improvements in the growth outlook.”

“We believe, however, that the markets may be less dependent on the future U.S. policy agenda and may instead draw support from the synchronized and organic recovery in global growth which began well before the elections even took place.”

“We are encouraged that the equity markets may well be supported here by the positive momentum of rising revenues and earnings, a strengthening labor market, rising wages, strong demand for housing, improving foreign economies, the potential for fiscal stimulus, continued accommodative monetary policy around the world, low inflation and low-interest rates.”

From Investments to Family Office to Trustee Services and more, we are your single-source solution.