It was not too long ago that prospects for the global economy appeared promising on the heels of recent breakthroughs. The year began on a positive note as a number of lingering worries such as the trade war with China and Brexit were resolved. The upbeat outlook for global economies and markets remained largely unchanged even during the early outbreak of the novel coronavirus in China. Stock prices rose until February 19, 2020 before collapsing in dramatic fashion.

Fears of a broader virus contagion swept through the markets in late February to trigger a correction within 6 trading days. The World Health Organization (WHO) declared coronavirus a global pandemic on March 11 as cases surged rapidly in Europe and the U.S. Public health safety considerations resulted in social distancing and shutdowns. The ensuing Great Suppression brought global economies to a sudden stop.

Market and economic activity in the month of March was unprecedented at many levels. We witnessed the fastest ever bear market in 21 days, the most volatile month ever in terms of daily price fluctuations and the sharpest spike ever in weekly unemployment claims to a peak of 6.9 million.

The dizzying pace of price changes in March left market participants stunned and shocked. It also reminded investors of the basic principles of a well-designed portfolio that is able to weather any storm — broad diversification, adequate liquidity and high quality investments.

In the backdrop of the coronavirus crisis, we focus on the theme of investing in high quality, secular growth companies. We do so from a few different perspectives:

- Provide empirical evidence of how they hold up better during recessions.

- Develop a fundamental framework for why they are better able to hedge recession risks.

- Make a case for owning them as a powerful driver of long-term wealth creation.

For our discussion here, we approximate the behavior of higher quality growth stocks with more traditional indexes of Growth stocks. We recognize that all Growth is not Quality. But the two groups of stocks are reasonably correlated and the approximation allows for both an easier historical performance comparison and a more conservative validation of the Quality effect.

At the other end of the spectrum, we use Value and Cyclical stocks as a proxy for lower quality stocks.

Resilience of Quality in a Crisis

High quality companies tend to be characterized by stronger balance sheets, lower leverage, sustainable competitive advantages and steady cash flow generation.

We intuitively expect these fundamental traits to become more valuable during economic slowdowns and recessions. As overall growth becomes scarce or negative, those companies which can deliver growth reliably and consistently are likely to be rewarded.

While there may be the inevitable exceptions, high quality growth companies have generally done well during economic recessions.

We use the Growth and Value proxies for high and low Quality to look at recent recessions.

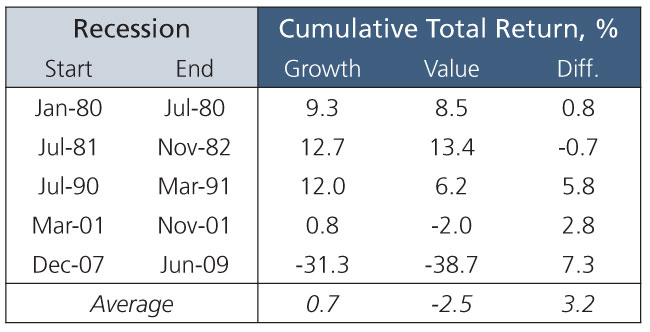

Figure 1 shows the average outperformance of Growth stocks in the Russell 1000 index over Value stocks covering the official duration of the last five recessions.

Figure 1: Relative Performance of Growth and Value Stocks

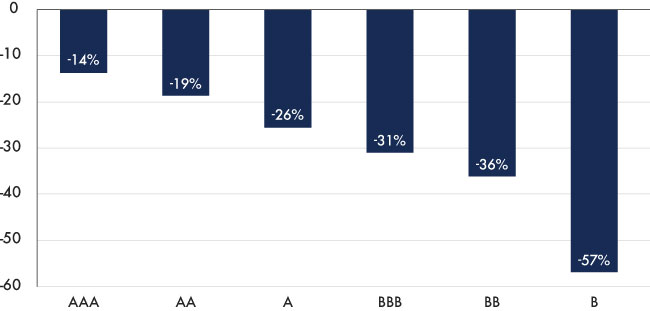

Figure 2 shows the performance of S&P 500 companies by credit ratings during the first quarter selloff.

Figure 2: Higher Quality Companies Have Performed Better

S&P 500 Credit Categories from 2/19/20 – 3/31/20, %

Quality has been handsomely rewarded in the current crisis. AAA-rated companies in the S&P 500 out-performed B-rated companies by more than 40% from the market peak on 2/19/20 until the end of the quarter!

A Better Hedge Against Recession Risks

We assert a fundamental thesis that high quality companies are better able to handle recession risks.

We arrive here by revisiting some basic principles of stock valuations and risks.

An investment in stocks is quite simply the partial ownership of a company’s future cash flows. By extension, the price of a stock is just the discounted present value of these future cash flows.

Price = Future Cash Flows / Discount Rate or Interest Rate Factor

A number of interesting observations emerge from these basic building blocks:

1. There are two primary sources of risk in the market portfolio for stocks.

- Economic events may change the magnitude of future cash flows.

- Investors may change the discount rate or cost of capital that they apply to future cash flows.

We identify these two risks as cash flow risk and interest rate risk.

The former can also be described as recession risk and the latter as duration risk, a concept with which bond investors are all too familiar.

2. Cash flow risk is generally considered to be more damaging to stock portfolios than interest rate risk.

- Cash flow shocks tend to be larger in magnitude and can be devastating during recessions.

- They can be even more damaging for low quality companies since large cash flow declines could trigger defaults and bankruptcies.

- On the other hand, interest rate risk is more benign because it tends to be counter-cyclical. Rising interest rates can hurt stock valuations but rates are likely to go higher in a strong economy when cash flows are also rising.

For these reasons, cash flow risk has come to be recognized in the financial literature as “bad” risk and interest rate risk as “good” risk1. The comparison is strictly relative; both risks can impair portfolio values.

How does all this relate to investing in high quality companies during a recession?

Well, it turns out that high quality growth companies possess two attributes that allow them to better withstand recessions. They tend to have more exposure to “good” interest rate risk and less exposure to “bad” cash flow risk.

We support this generalization with the following evidence.

We revert again to the Growth and Value/Cyclical proxies for high and low quality companies respectively.

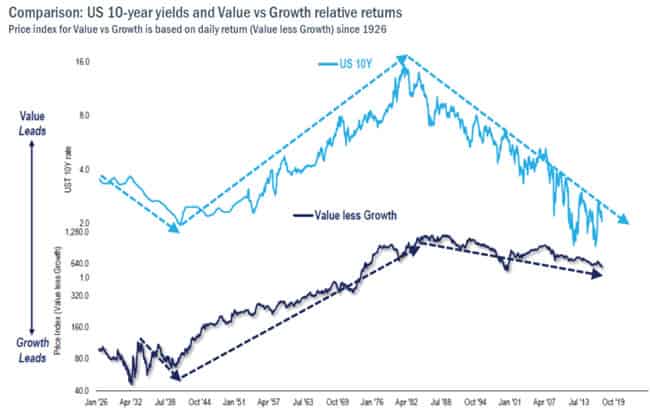

Figure 3 looks at the relationship between changes in interest rates and the relative performance of Growth and Value stocks.

Figure 3: Interest Rate Changes and Growth / Value Performance

To validate our hypothesis that Growth stocks have higher exposure to interest rate risk than Value stocks, we would expect Growth stocks to underperform when rates are rising and outperform when rates are falling.

We find that to be the case in the chart above. Growth underperforms and Value outperforms when rates rise. On the flip side, Growth outperforms and Value underperforms when rates fall.

We look next for evidence that high quality companies are less vulnerable to cash flow shocks. We measure this effect by looking at earnings declines for Growth and Cyclical stocks during market selloffs.

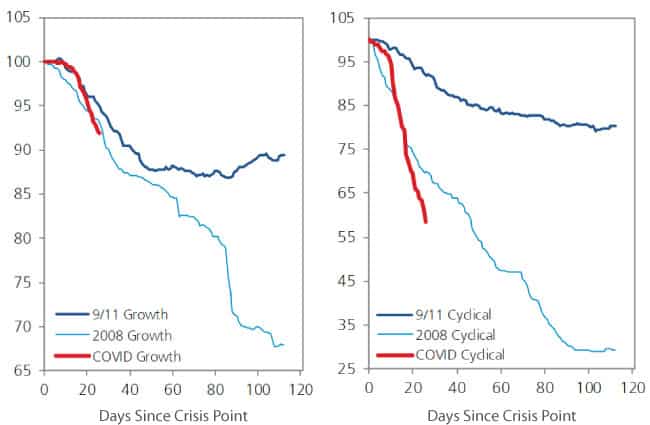

Figure 4: Earnings Declines in Crises

Source: FactSet, UBS

The chart on the left in Figure 4 shows earnings declines for Growth stocks through the 9/11, 2008 and COVID selloffs. The chart on the right shows the same information for Cyclical stocks.

On the left, we see that earnings for Growth stocks declined by less than -35% in 2008 and by less than -10% in the early days of COVID. Over the same time period, we see on the right that earnings for Cyclical stocks fell by nearly -75% and -40% respectively.

High quality companies are fundamentally able to withstand recessions better because they are less vulnerable to cash flow risks.

But we believe that their role within a portfolio extends beyond providing downside protection during a recession. We also look at their ability to create long- term wealth.

Quality as a Driver of Long-term Wealth

We mentioned earlier that high quality companies tend to have strong balance sheets and are likely to generate steady cash flow. These companies have typically been able to parlay these attributes into greater profitability, higher earnings growth and higher free cash flow margins.

A simultaneous emphasis on both high quality and secular growth may deliver several benefits to the long-term investor. Higher-than-market secular growth and profitability is likely to overcome changes in valuations over time and generate long-term outperformance.

A strong and sustainable competitive advantage, which is a hallmark of high quality companies, can support both secular growth and profitability. The possession of a wide economic moat to defend the competitive advantage may also allow long holding periods, low turnover and tax-efficient compounding of wealth across generations.

The Quality theme plays a big role in our investment process. We continue to prefer higher quality U.S. stocks over foreign stocks and our top U.S. equity holdings include Microsoft, Amazon, Visa, Apple and Google.

On a final interesting note, we are struck by the significantly divergent impact of the coronavirus pandemic at either end of the Quality spectrum. In the case of Microsoft and Amazon, the pandemic has bestowed new cyclical advantages to the already powerful secular tailwinds behind these high quality companies.

At the other extreme, the unprecedented decline in economic activity may see the end of several companies in sectors like Travel, Leisure and Energy. A business model of high leverage, high sensitivity to cash flow shocks and high reliance on commodity prices makes these companies vulnerable to a prolonged recession.

Summary

The unprecedented market volatility in March 2020 left investors stunned and searching for answers on managing downside risks within portfolios. We highlight the merits of investing in high quality growth companies for both downside protection and for long- term wealth creation.

We provide evidence on their ability to withstand selloffs during a crisis. We also explain fundamentally why high quality growth companies are better able to weather recessions. We show that their resilience is derived from a lower exposure to cash flow shocks that typically surface during a recession.

We also make a case for Quality to be a potentially powerful driver of long-term returns. High quality growth companies are likely to benefit from stronger balance sheets, more defensible competitive advantages, greater profitability, higher earnings growth and more enduring valuations over the long run.

Our emphasis on high quality companies has helped us in both up and down markets over time. Our focus on diversification, liquidity and quality has especially served our clients well during this crisis.

1 Campbell et al, Bad Beta, Good Beta, American Economic Review (2004)

“The dizzying pace of price changes in March left market participants stunned and shocked.”

“It also reminded investors of the basic principles of a well-designed portfolio that is able to weather any storm – broad diversification, adequate liquidity and high quality investments.”

“High quality companies are likely to benefit from stronger balance sheets, higher earnings growth and more enduring valuations over time.”

From Investments to Family Office to Trustee Services and more, we are your single-source solution.