Watch this video of Sandip Bhagat, our Chief Investment Officer, discussing the latest market insights.

Slow... But Steady

The last four years have felt like one endless blur of unprecedented events ... all unfolding in rapid succession. And 2023 was no different; it was perhaps even more extraordinary than the previous three years.

The surprises in 2023 were numerous. Much like the spectacular spike in inflation, the pace of disinflation in 2023 was remarkably rapid as well. Even as long-term interest rates rose unexpectedly in the second half, the U.S. economy remained remarkably resilient. As a result, U.S. large cap stocks performed magnificently in 2023 as the S&P 500 index gained 26.3%.

At the dawn of a new year, we reflect on our 2023 predictions with fond satisfaction.

We had practically ruled out the possibility of a deep and protracted recession in 2023. Our base case for the economy last year was a soft landing – with a short and shallow recession as the worst case scenario.

Our optimism on economic growth was based on what we believed were under-appreciated tailwinds from the post-pandemic stimulus. We perceived that the residual effects of prior monetary and fiscal stimulus were likely to offset the headwinds of higher inflation and higher interest rates.

Our view on inflation at the beginning of 2023 was relatively benign. We felt that fears of sticky and stubborn inflation were overblown. We predicted that core measures of inflation would be closer to 3% by the end of 2023. As a result, we also felt that the Fed would end up with more flexibility on future rate cuts than it believed or the market expected.

And finally, our constructive views were also reflected in our stock market outlook for 2023. We had ruled out the possibility of retesting prior lows in stock prices or making new ones. Our expectation for solid double-digit gains was based on the view that earnings growth would bottom out by mid-2023 and then rise subsequently.

We are pleased that these views were validated by what transpired in 2023. We were misguided, however, in our forecast that bonds would provide a decent term premium. Bonds were in negative territory for most of 2023 and finally eked out positive returns in the midst of high volatility.

Today, the odds of a recession have receded significantly and a soft landing is now the consensus view. We begin to develop our 2024 outlook from this vantage point.

Drivers Of The 2024 Outlook

Even as market optimism turned higher at the end of 2023, a number of concerns still linger in the minds of investors. Here, in no particular order, we walk through a long list of worries that investors may yet harbor.

- An inverted yield curve has been a reliable predictor of recessions in the past. At this point, the yield curve has been inverted for more than 300 days.

- Leading economic indicators have declined steadily for almost a year and a half.

- Bank deposit growth and money supply growth are both in negative territory and close to levels seen in the 1930s.

- The adverse economic effects of Fed tightening tend to be felt on a lagged basis – many fear the worst is yet to come.

- The last mile of disinflation may prove difficult or even elusive.

- The Fed may make a mistake by keeping policy too restrictive and interest rates too high for too long.

- And finally, investors fret that stock valuations and earnings growth expectations are too high.

We address these concerns in forming our 2024 outlook by taking a closer look at inflation, growth, interest rates, profit margins, stock valuations and the earnings outlook.

Our headline summary is more constructive than the concerns highlighted above.

a. We believe GDP growth will continue to slow but only to below-trend levels; it is unlikely to turn negative.

b. We assign low odds to a moderate or deep recession and believe that growth may surprise to the upside.

c. Inflation will continue to recede but may normalize above the Fed’s 2% target.

d. Earnings may exceed expectations due to a potential improvement in profit margins.

e. We expect that both stocks and bonds will deliver modestly positive returns.

We validate our outlook with a closer look at four key fundamental drivers: inflation, interest rates, growth and earnings.

Inflation

We have made significant progress with disinflation in recent months ... probably more than many had expected.

And yet, two concerns remain on the inflation front.

- Will any unusual economic strength rekindle inflation and send it higher?

- Will the last leg of disinflation simply be too stubborn and difficult to achieve?

Inflation is unlikely to revert meaningfully higher for a number of reasons.

One, the sticky shelter component of inflation has just turned the corner and will continue to head predictably lower.

Two, the job market has long peaked in strength and will continue to weaken further. This will exert downward pressure on wage inflation.

And finally, we believe that the recent gains in productivity will continue into 2024.

Pandemic-related disruptions caused productivity to plummet. Employers had to scramble to train new workers who initially were not as productive as their predecessors. As the labor force normalizes, a pickup in productivity gains will ease overall inflation.

And this brings us to our second question: Can inflation subside all the way down to the Fed’s 2% target? And if so, how soon?

Our view here is a bit mixed. We believe inflation will continue its orderly decline in 2024. We expect headline and core inflation to soon head below 3%. However, we suspect that inflation may eventually come to rest below 2.5%, but above the Fed’s 2% target.

A couple of factors inform our view here. We expect growth to remain modestly resilient in 2024. We also expect an ageing population to constrain labor supply and put a higher floor on wage inflation.

Finally, we believe that even inflation of almost 2.5% will still be favorable for stocks and bonds.

Interest Rates

Our positive outlook on inflation makes it easy to develop a view on interest rates. We begin with the Fed and then move to long-term interest rates.

The Fed’s policy rate of 5.4% is already far above inflation which is averaging 3-3.5% on a year-over- year basis. The implied short-term real interest rate, which is simply the spread between policy rates and inflation, of 2-2.5% is already quite restrictive. We rule out any further rate hikes; the Fed is done with tightening.

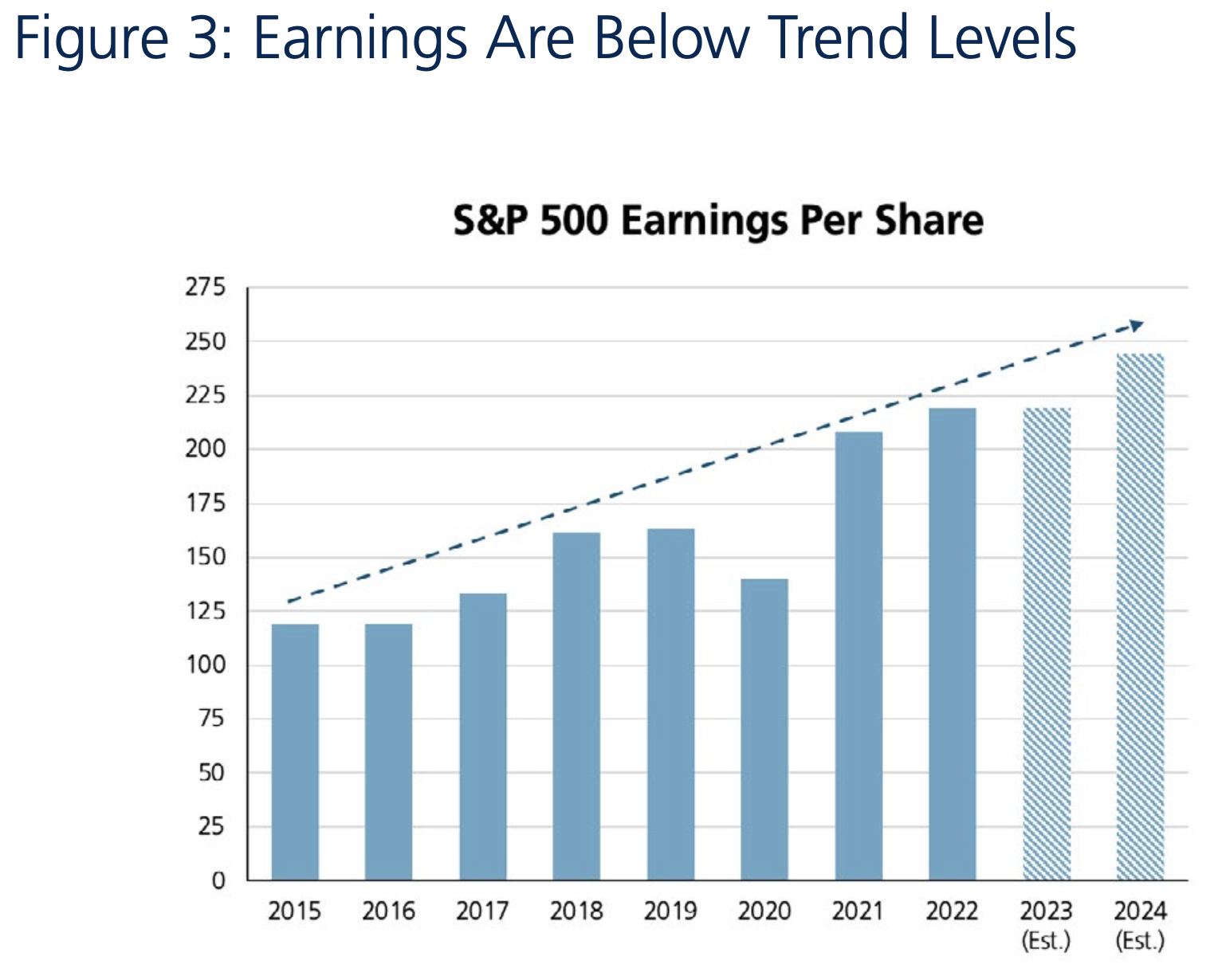

Figure 1 shows just how restrictive Fed policy has become in recent months.

Source: FactSet

The blue bars in Figure 1 show 12-month core PCE inflation (PCE stands for Personal Consumption Expenditures). Core PCE is the Fed’s preferred inflation gauge.

We can see how core PCE has fallen steadily in 2023 and is projected by the Fed itself to fall further in 2024.

The green line shows the Fed funds rate which is now higher than inflation by well over 2%. Under normal conditions, the Fed funds rate exceeds inflation by about 0.5%. A real short-term interest rate in excess of 2% is clearly restrictive. If inflation falls by another 1% or so in 2024, the Fed will have the flexibility to cut rates several times.

We expect five to seven rate cuts in 2024 beginning in March or May.

We are cognizant of the possibility that the Fed begins later and implements fewer rate cuts. Such a policy misstep would undoubtedly magnify the depth of the slowdown. But it is still unlikely to be a devastating event for the markets; we reckon the economy is just less rate-sensitive now than before.

Our view on the 10-year Treasury bond yield is derived from our outlook on inflation. We expect inflation to normalize below 2.5% in 2024. We expect a positively sloped yield curve to evolve over time. We also predict positive real rates and a positive term premium in the future.

We coalesce these thoughts to form our forecast for the 10-year Treasury bond yield in the range of 3.7-3.9%.

Growth Prospects

A long list of reliable indicators argue for a traditional, perhaps even a deep, recession in 2024 – just like they did in 2023.

In 2023, our counter-view on the topic was based on the under-appreciated tailwinds of massive prior stimulus from 2020 to 2022. A simple example of this support was the excess savings that consumers had accumulated from the post-pandemic fiscal stimulus. One of the legacies of ultra-low interest rates from that period was that consumer and corporate debt got locked in at low fixed rates.

For 2024, we argue against a modest or deep recession along different lines.

The biggest concerns right now revolve around the consumer and the job market. Many fear that it is only a matter of time before the consumer wilts under the pressure of high interest rates. And as the job market begins to soften, the skeptics fear it will eventually lead to the dreaded 1% increase in the unemployment rate.

We tend to disagree with both narratives.

We have pointed out extensively that the U.S. economy is less sensitive to interest rates now than it has been in the past. The consumer may, therefore, be more insulated from the lagged effects of Fed tightening. We also note that discretionary spending for lower income households is more affected by rent, food and energy costs than it is by interest rates.

And as resilient as the job market has been, we find it hard to believe that the unemployment rate will go above 4.5%. So far, employers have hoarded labor to prevent disruptions; we expect this trend to continue.

We conclude with our key under-appreciated takeaway on the growth front. Lower inflation in 2024 will help support consumer spending and offset the lagged impact of higher interest rates.

Earnings Outlook

Stocks have sold off in the early going so far in 2024. There is now a growing sense of foreboding that both earnings expectations and stock valuations may be too high. It is feared that these, in turn, may lead to mediocre stock market returns in 2024.

S&P 500 earnings for 2024 are projected to grow by about 11%.

Investors perceive risk in this 11% earnings growth estimate for 2024 because of a well-documented historical pattern. Analysts chronically overestimate earnings at the beginning of a year. As the year progresses, those estimates come down predictably by 4 to 8 percentage points.

We are aware and respectful of that trend. However, we identify a couple of potential positive offsets to that downtrend.

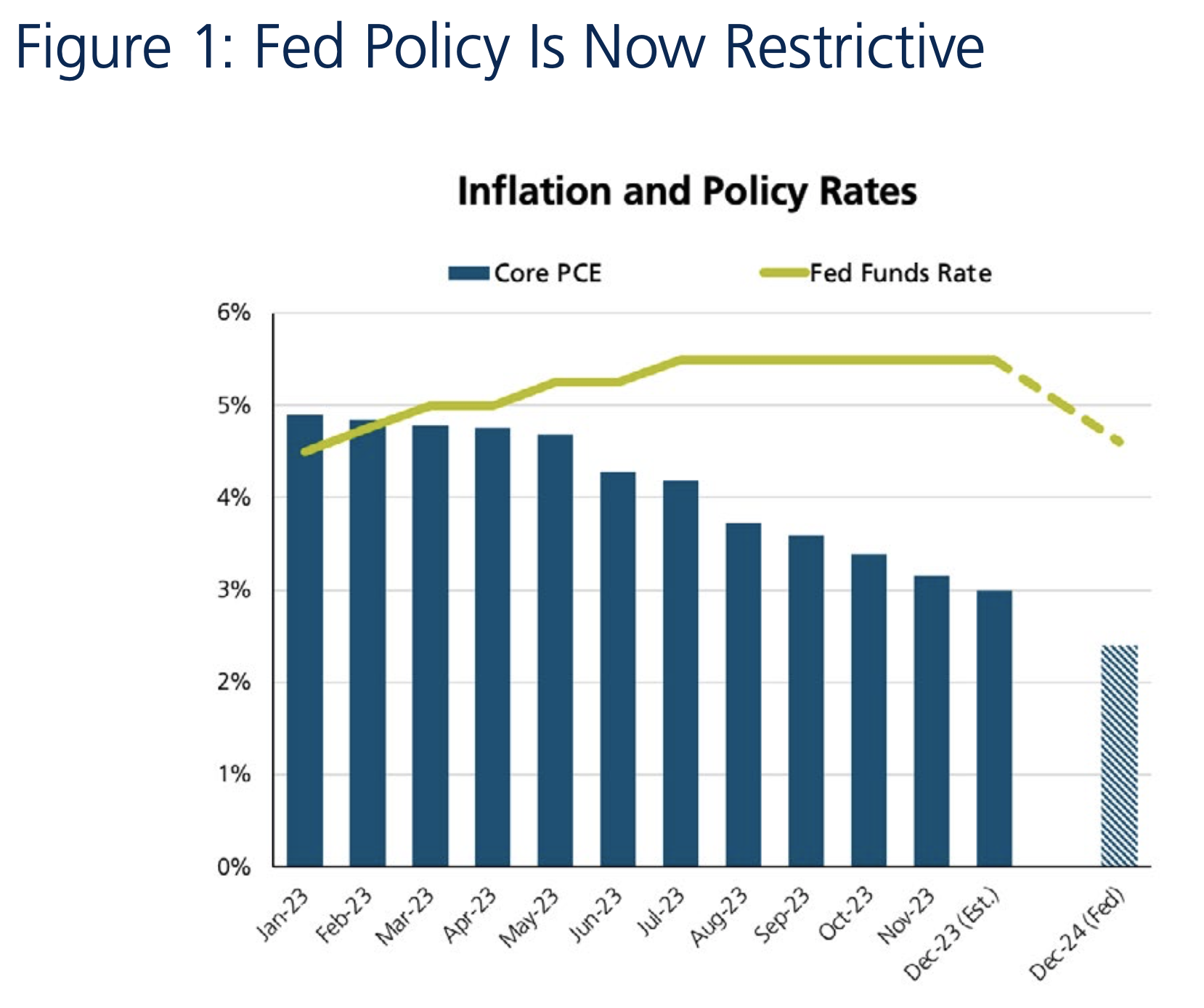

Profit margins have been compressing for the last year and a half because of high inflation. Higher input costs for labor and raw materials generally cause margins to decline.

We see this downtrend in Figure 2.

Source: FactSet

Source: FactSet

Inflation in 2024 will be a lot lower than it was in 2022 and 2023. We expect that a lower cost of goods sold will improve profit margins and provide some upside to earnings. The decline in interest rates should also help profit margins to some extent.

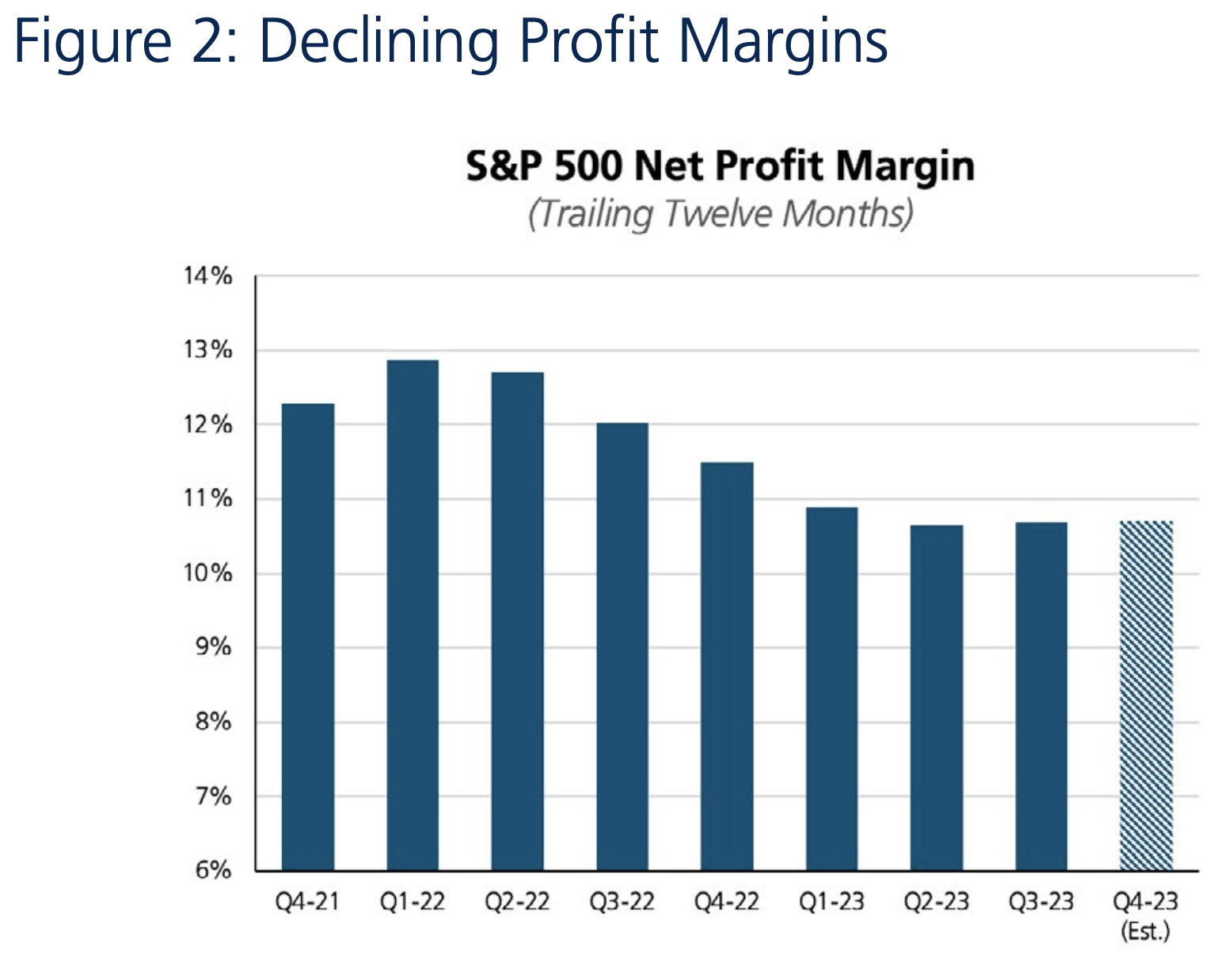

We also note that earnings have been unusually erratic in the last ten years or so. A crisis in commodities and currencies roiled markets in 2016. The Trump tax cuts abruptly boosted earnings in 2018. The pandemic wreaked havoc in 2020 and then war and excessive stimulus unleashed inflation and curtailed profits in 2022 and 2023. We see this wayward trajectory of earnings in Figure 3.

Source: FactSet

S&P 500 earnings per share for 2023 will likely come in within a range of 219-220. This is well below the trend level of earnings assuming historical growth rates from 2015 onwards. We notice that even the 244 level of earnings forecasted for 2024 remains below the trend line of normalized earnings. As macro headwinds diminish, we are optimistic that the consensus earnings forecast for 2024 will be met or exceeded.

And finally, a word on stock valuations.

The forward P/E ratio for the S&P 500 currently stands at about 19 times. While it is high by historical standards, it is not so different from recent averages. We believe that the stock market is gradually evolving to a structurally higher normalized P/E than its long- term historical average.

The S&P 500 index in aggregate produces free cash flow margins of about 10% and return on equity of around 20%. These are unprecedented levels of high profitability. We believe these are sustainable levels of profitability for large U.S. companies going forward and, therefore, supportive of higher stock valuations.

We are more tolerant of today’s P/E ratios than most investors.

2024 Outlook

We are aware of the long list of indicators that still argue in favor of a recession. These include the continued inversion of the yield curve, steadily declining leading economic indicators and negative growth in bank deposits.

- We acknowledge these factors will continue to slow down growth. Our base case calls for below- trend, but still positive, GDP growth. Our worst case scenario is a short and shallow recession. We assign low odds to a traditional or deep recession.

- Lower inflation in 2024 will support consumer spending and offset any lagged effects of higher interest rates. Even as the job market softens, the unemployment rate will remain well below 4.5%.

- We do not anticipate any meaningful uptick in inflation from here on. Inflation should continue to decline in a fairly orderly manner to below 2.5%. The impetus for lower inflation in 2024 will come from declining shelter inflation, a weaker job market and continued productivity gains.

- It may be difficult to achieve the Fed’s 2% inflation goal in the next couple of years. A higher floor on inflation may emerge from a couple of factors: modestly resilient growth in the near term and an ageing population which limits labor supply in the long run.

- With the significant progress on disinflation, the Fed is already quite restrictive in its policy. If inflation falls further in 2024, the Fed will have the flexibility to cut rates several times. We expect five to seven rate cuts in 2024 beginning in March or May. We expect the 10-year Treasury bond yield to normalize just below 4%.

- We do not expect political or geopolitical risks to materially affect stock or bond returns.

- For calendar year 2024, we forecast mid-single digit bond returns and high single digit stock returns. We see more upside for stocks than we do for bonds. We remain bullish on stocks but at a lower portfolio weight than in prior years.

We are more comfortable with earnings estimates and stock valuations than the current consensus view. We believe that lower inflation in 2024 will lead to higher profit margins overall. We also believe that higher P/E ratios are fundamentally supported by the higher profitability of companies within the S&P 500 index.

We are confident that the battle against inflation has been largely won and will soon come to an end. Investor focus is now squarely on growth, which becomes the key determinant of investment performance.

We realize that a lot of uncertainty still persists about the future trajectory of economic and earnings growth. As a result, we emphasize high quality and sustainable competitive advantages in our investment decisions. After a highly rewarding year, we will exercise even more caution and care in client portfolios.

We believe GDP growth will continue to slow but only to below-trend levels; it is unlikely to turn negative.

Inflation will continue to recede but may normalize above the Fed’s 2% target.

Earnings may exceed expectations due to a potential improvement in profit margins.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.

Source: FactSet

Source: FactSet