Foreign Contagion Risks and the Policy Path

The U.S. economy continues to show remarkable resilience in the face of stubbornly high inflation and tighter financial conditions. Core inflation, which is more influenced by the sticky components of rents and wages, remains elevated even as headline inflation recedes at a glacial pace. The Fed has already raised short rates from zero to 3% and remains steadfast in its commitment to more rate hikes.

The fallout from persistent inflation and a hawkish Fed has led to several adverse outcomes. The U.S. dollar and long-term bond yields continue to soar higher. And stock prices continue their downward trajectory as they discount rising risks of a global recession.

Despite the Fed’s efforts to cool the economy down, the jobs market remains surprisingly strong. The unemployment rate is still at its all-time low of 3.5% and weekly unemployment claims are close to historical lows. There are still 10 million job openings, which far exceed the available pool of 6 million unemployed workers.

Healthy job creation and steady wage gains have supported consumer incomes and spending. As a result, real GDP growth for the third quarter is projected to rebound from negative levels in the first two quarters to above +2%.

On the policy front, the Fed has repeatedly communicated that restoring price stability now is crucial for achieving sustainable growth and full employment in the long run. In this context, the Fed has made it abundantly clear that it is willing to accept “short-term pain for long-term gain”.

The current economic backdrop in the U.S. will likely encourage the Fed to continue tightening aggressively. After all, why worry about the possibility of breaking something in a big way or unleashing systemic risk from a financial crisis when we haven’t even slowed the economy materially?

With investor focus squarely on U.S. inflation and Fed policy, it may be worthwhile at this juncture to take a closer look at the broad global economic landscape. The U.S. has enjoyed strong growth fundamentals through both the Covid crisis and this latest inflation shock. The rest of the world has not been so fortunate. The inflation problem is significantly worse and growth is materially weaker outside the U.S.

In a still tightly integrated global economy, we examine the impact of U.S. policy actions on global growth. To what extent has the rapid pace of Fed tightening contributed to global economic stress?

At a more relevant level, we also assess the risks of contagion back to the U.S. from ailing foreign economies. We focus on two themes:

- Can the U.S. remain an oasis in an increasingly barren global growth landscape and avoid cross-border contagion?

- Can U.S. policy responses better mitigate global systemic risk and minimize contagion risks?

We look at recent developments in key foreign economies. We identify the strong dollar as a potential driver of future U.S. and global weakness. Finally, we offer some thoughts on the Fed’s optimal policy path forward within a broader global context.

Foreign Economic Risks

We begin our brief tour of foreign economies with a quick look at recent volatility in the U.K. bond market and its global fallout.

On September 23, the new administration in the U.K. announced a new fiscal plan to spur growth from supply-side reform and tax cuts. However, this focus on fiscal stimulus was at odds with restrictive monetary policy from the Bank of England and risked a further escalation of already-high inflation.

The lack of any funding details also raised concerns about an unsustainably higher debt burden and sent U.K. bond yields soaring. This upward spiral in bond yields was further exacerbated by forced liquidation of U.K. long-term bonds, also known as gilts, by local pension funds.

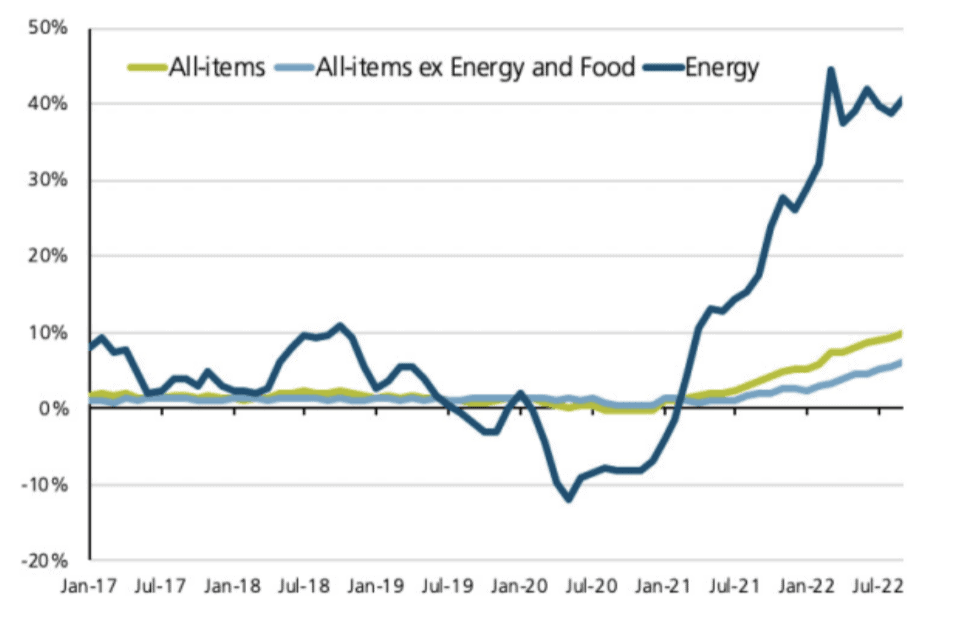

The unexpected rise in U.K. bond yields spread through the global bond and currency markets. This contagion is seen clearly in Figure 1.

![]()

Source: FactSet as of October 12, 2022

Immediately after the initial announcement, the 30-year U.K. gilt bond yield (shown in green) rose by more than 100 basis points to almost 5%. The spike in U.K bond yields reverberated across the globe. The 10-year U.S. bond yield (dark blue) moved higher by 50 basis points to almost 4% and the U.S. dollar strengthened against the British pound (light blue) by more than 5%. Higher bond yields and the strong dollar, in turn, sent U.S. stocks significantly lower at the end of September.

The rise in U.K. bond interest rates also highlighted another vulnerability for the global economy. As much as higher interest rates crowd out consumer spending in any economy, the problem is particularly severe in foreign economies.

The U.S. consumer is unique, and fortunate, in being able to access fixed rate long-term mortgages ranging in term from 15 to 30 years. For example, think about a U.S. household that refinanced its long-term mortgage during the period of low interest rates prior to 2022. With a low interest rate locked in for many years, that household is now immune to higher housing costs from rising mortgage rates.

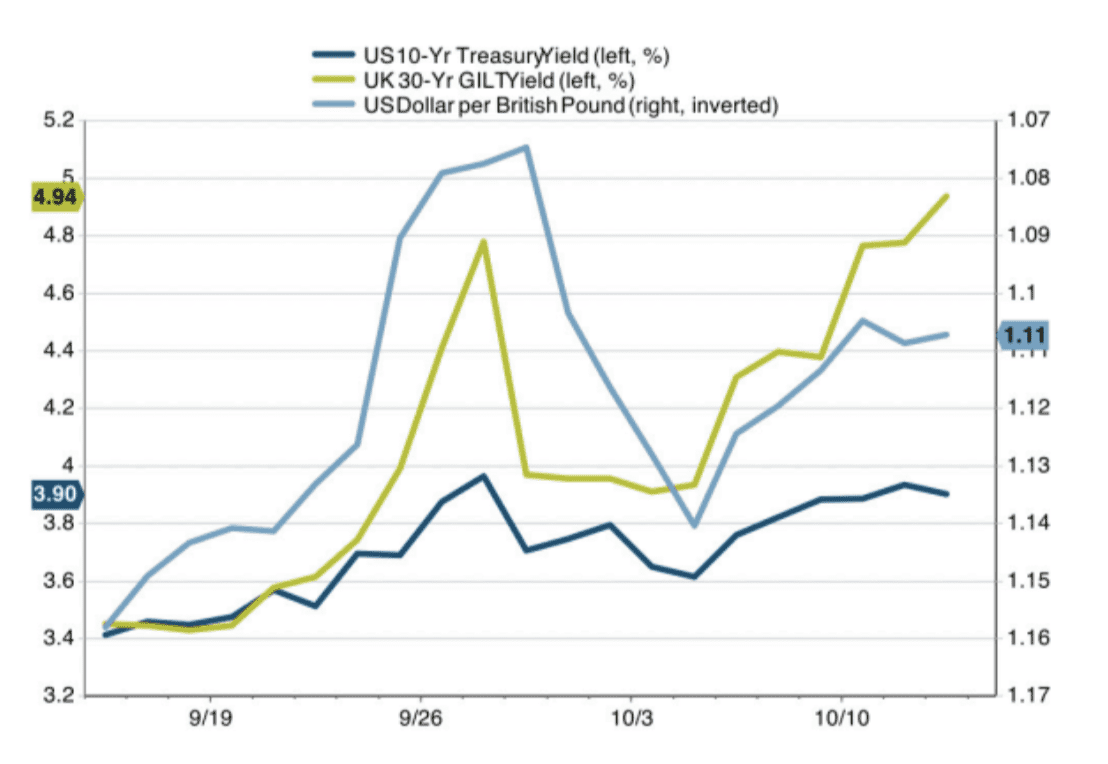

Our readers may find it interesting to note that few mortgages overseas are at a fixed rate over long terms. Figure 2 provides a glimpse of how mortgages vary across countries by the term over which the interest rate is fixed.

![]()

Source: European Mortgage Federation

More than 90% of mortgages in the U.S. have a fixed rate over a long term in excess of 10 years. In Germany and Spain, that proportion drops to just around 50%. The impact of rising rates on housing costs is even worse in the U.K., where long-term fixed rate mortgages simply don’t exist.

More than 90% of mortgages in the U.K. offer a fixed rate for only 1-5 years. In a country already hit hard by high inflation, the greater proportion of mortgages resetting to a higher rate and higher payments significantly add to the odds of a U.K. recession.

The situation is also grim in Europe, but for a different set of reasons. Europe’s historical dependence on Russian energy is well known. Prior to the war with Ukraine, roughly 40% of Europe’s natural gas imports came from Russia. Since the invasion, Europe has looked for new sources of supply and Russia has retaliated by shutting off some of its existing supply of gas.

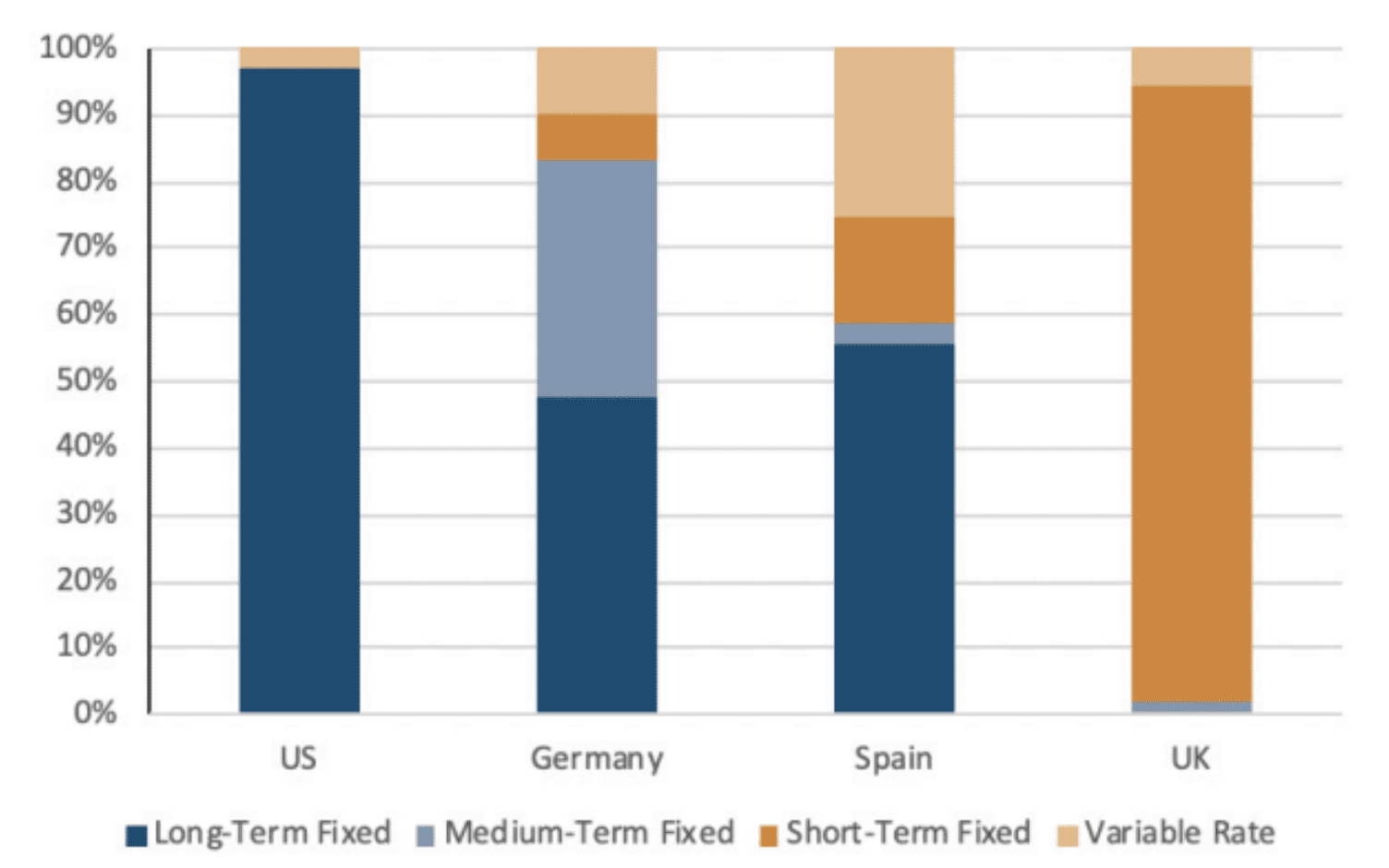

The resulting energy shortfall in Europe has led to sky-high energy prices, high inflation and significantly weaker growth. We show the outsized impact of energy costs on Eurozone inflation in Figure 3.

![]()

Source: European Central Bank

The nearly ten-fold increase in natural gas prices in Europe has led to a mega-spike in energy inflation and double-digit headline inflation in Europe. While energy inflation in the U.S. has started to decline, it shows no signs of abating in Europe. And things are likely to get worse during the dark winter months as Europe contemplates reduced energy consumption. Any cutbacks in production within energy-intensive sectors will likely lead to more layoffs and lower economic growth.

European policymakers are particularly hamstrung in balancing inflation and growth considerations at this point. The inflation problem in Europe emanates from a true supply shock, which cannot be remedied simply by raising interest rates. Any fiscal stimulus to counter lower industrial production and employment runs the risk of driving already-high inflation even higher.

Our baseline outcomes for Europe are listed below.

- The European Central Bank is unlikely to hike rates as aggressively as the Fed.

- A weak Euro will likely contribute to higher energy prices and more persistent headline inflation.

- Europe may be forced to consider fiscal stimulus at some point to soften the recessionary hit.

Finally, we touch briefly on growth challenges in China. For a long time, China’s high growth trajectory was achieved by investment and trade. It has recently tried to shift growth more towards domestic consumption, but with limited success. China’s two key drivers of growth are now under significant pressure.

China’s investment share of GDP is almost twice the global average and has come at the expense of an unsustainable surge in debt. As an example, the heavily indebted real estate sector is now slowing dramatically. A zero-Covid policy has reduced mobility of people, goods and services, increased supply chain problems and decreased global trade. China’s trade and competitiveness have been further compromised by the new U.S. export controls on semiconductor chips and machinery.

We note in summary that foreign economies are far more fragile than the U.S. and remain quite vulnerable to policy missteps and exogenous shocks.

Pitfalls of a Strong Dollar

The U.S. economy is stronger than any foreign economy for a number of reasons. The recent monetary and fiscal stimulus in the U.S. was the largest in the world. As a result, the U.S. consumer is still resilient and its jobs market is still strong. U.S. inflation is, therefore, as much a demand issue as it is a supply-side shock.

As we have discussed above, this is not the case in the rest of the world. Foreign central banks are unable to raise rates aggressively because of weaker demand. Foreign inflation is also far less of a demand issue than it is a true supply-side shock.

This divergence between growth and policy dynamics in the U.S. and the rest of the world argues for continued dollar strength. We highlight two key risks from a persistently strong U.S. dollar.

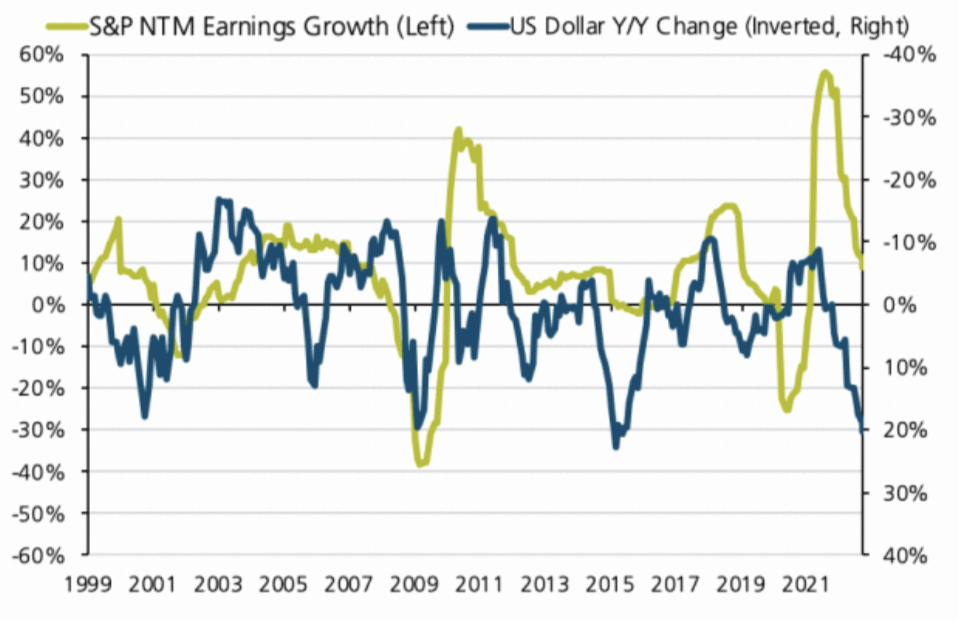

First, a strong dollar reduces earnings for U.S. multinational companies from a simple currency translation effect. Revenues booked in foreign countries get translated back to lower dollar levels at a higher exchange rate. Figure 4 shows this intuitive strong-dollar / weak-earnings relationship.

![]()

Source: Bloomberg

The blue line in Figure 4 shows the year-over-year change in the U.S. dollar on an inverted scale on the right axis. A downward sloping line, therefore, denotes dollar strength. The green line shows the year-over-year growth in S&P 500 earnings estimates for the next twelve months (NTM) on the left axis.

We can clearly see here that S&P 500 earnings go down as the dollar goes up. A sustained rally in the U.S. dollar going forward could further reduce corporate profits and potentially trigger a dangerous self-reinforcing spiral of more layoffs, lower consumer spending, weaker economic growth, lower company revenues, back to lower profits … and so on.

And second, a strong dollar poses risks to foreign economies as well. A strong U.S. dollar raises the cost of their imports and drives up their inflation. Supply-side energy inflation is already high overseas; a strong dollar only makes this bad situation worse. Currency fluctuations affect trade balances and foreign exchange reserves. And emerging market economies find it increasingly difficult to service their dollar-denominated debt.

The strength of the U.S. dollar remains an important conduit for global contagion of economic weakness.

Possibilities for the Policy Path

The Fed has repeatedly reiterated its relentless pursuit of monetary tightening to quell inflation. It has so far been unmoved by the prospects of a U.S. or global recession.

We have recently suggested that the Fed may be well served from a shift in positioning where it becomes less rigid and more data-dependent. Our view is based on the observation that real-time U.S. inflation is likely coming down even as lagged measures of inflation such as shelter CPI continue to rise. We believe that the downward trajectory in upstream and coincident inflation will eventually bring overall inflation below policy rates.

Our focus on the fragility of foreign economies bolsters the argument for a more flexible approach to Fed policy. There is now an increasing chance that a central bank or government misstep is an accident waiting to happen. The calamitous fallout from the U.K. mini-budget crisis is just one small example.

We also believe that it is premature for the Fed to pause right now and a grave mistake for it to pivot towards rate cuts. We support the notion of continued rate hikes in 2022 to keep inflation expectations in check.

However, the Fed will likely have done enough and the U.S. and global economies will likely have weakened enough for the Fed to signal a pause in early 2023. A prescriptive upward march in U.S. policy rates in 2023 may very well lead to an unexpected and dire financial crisis somewhere in the world.

Summary

We are still in the midst of unprecedented economic and market uncertainty. U.S. core inflation remains sticky even as more timely measures of inflation appear to be declining in real time. Foreign inflation is less influenced by demand and largely remains a supply-side shock.

Against this backdrop, foreign economies are fragile and especially vulnerable to policy missteps. We believe that a pause in rate hikes by the Fed in 2023 will mitigate the risks of unexpected financial crises.

We continue to emphasize our strong regional preference for the U.S. over foreign markets. We also continue to target sufficient liquidity reserves to help our clients weather this storm. More so than ever, we remain vigilant and prudent in diversifying risk within client portfolios.

Foreign economies are fragile and remain vulnerable to policy missteps and exogenous shocks.

The strength of the U.S. dollar remains an important conduit for global contagion of economic weakness.

A pause in rate hikes by the Fed in 2023 will mitigate the risks of unexpected financial crises.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.