De-Dollarization

Financial markets defied expectations as fears of a sharp and imminent recession failed to materialize. The S&P 500 index gained 16.9% in the first half of 2023. The Nasdaq 100 index soared 39.4% to lead the stock market rally. And even the lagging Russell 2000 index of small company stocks showed belated signs of life and rose 8.1%. As the economy showed unexpected signs of strength, the 10-year Treasury bond yield rose above 3.8% after trading below 3.3% in early April.

Headline inflation also surprised investors with a more rapid rate of decline than expected. The Consumer Price Index (CPI) stands at 4.0% year-over-year as of May 2023 … well below its June 2022 high of 9.1%. The Fed’s preferred inflation gauge based on Personal Consumption Expenditures (PCE) is also significantly lower at 3.8% through May. Core inflation measures remain sticky for the moment but are expected to decline meaningfully in coming months.

The impact of this progress on inflation has been felt in many different areas. The Fed stopped its string of 10 consecutive rate hikes in June. It has also signaled that the skip in rate hikes could eventually lead to a longer pause in the tightening cycle. The Fed’s shift in monetary policy from rapid tightening also spilled over into other markets.

The prospects of eventually lower policy rates along with unexpected economic resilience triggered the stock market rally. And more importantly for our discussion here, it continued to extend the recent bout of U.S. dollar weakness. The direction of the dollar has recently become a topic of intense debate as a number of threats have emerged to its status as the world’s reserve currency.

We assess the outlook for the U.S. dollar in light of the recent trend towards de-dollarization. We focus specifically on the following topics.

- Recent catalysts for de-dollarization

- Viable alternatives to the dollar

- Fundamental drivers of dollar strength

Let’s begin with a brief history of events that have led to the hegemony of the dollar so far.

A Brief History

We can think of a reserve currency as one that is held by central banks in significant quantities. It also tends to play a prominent role in global trade and international investments. The last couple of centuries have essentially seen two primary reserve currencies.

The British pound sterling was the dominant reserve currency in the 19th century and the early part of the 20th century. The United Kingdom was the major exporter of manufactured goods and services at that time, and a large share of global trade was settled in pounds. The decline of the British Empire and the incidence of two World Wars and a Great Depression in between forced a realignment of the world financial order.

The dollar began to replace the pound as the dominant reserve currency after World War II. A new international monetary system emerged under the 1944 Bretton Woods Agreement, which centered on the U.S. dollar. Countries agreed to settle international balances in dollars with an understanding that the U.S. would ensure the convertibility of dollars to gold at a fixed price of $35 per ounce.

The Bretton Woods system remained in place until 1971, when President Nixon ended the dollar’s convertibility to gold. As we are well aware today, the U.S. typically runs a balance-of-payments deficit in global trade by importing more than it exports. In this setting, it became hard for the U.S. to redeem dollars for gold at a fixed price as foreign-held dollars began to exceed the U.S. gold stock.

The dollar continued to maintain its dominant role even after the end of the gold standard. Its position was further bolstered in 1974 when the U.S. came to an agreement with Saudi Arabia to denominate the oil trade in dollars. Since most countries import oil, it made sense for them to build up dollar reserves to guard against oil shocks. The dollar reserves also became a useful hedge for less developed economies against sudden domestic collapses.

The dollar’s hegemonic status is important to the U.S. economy and capital markets and their continued dominance in the global economic order. The U.S. is unique in that it also runs a fiscal deficit where the government spends more than it collects in revenues. The U.S. dollar hegemony is central to this rare ability of the U.S. to run twin deficits on both the fiscal and trade fronts.

The virtuous cycle begins with a willingness by other countries to accept dollars as payment for their exports. As they accumulate surpluses denominated in dollars, the attractiveness of the U.S. economy and the faith in U.S. institutions then bring those same dollars back into Treasury bonds to fund our deficit and into other U.S. assets to promote growth.

The dominance of the dollar in the world’s currency markets is truly remarkable. Our research indicates that the dollar currently accounts for more than 80% of foreign exchange trading, almost 60% of global central bank reserves and over 50% of global trade invoicing.

The importance of dollar hegemony cannot be overstated. At the same time, its dominance in perpetuity also cannot be taken for granted. In fact, the constant assault on the dollar has already seen its share of foreign exchange reserves decline from over 70% in 1999 to just below 60% now.

A number of new threats to the dollar have emerged within the last year or so. These developments have triggered renewed fears of de-dollarization and are worthy of discussion.

Recent De-Dollarization Catalysts

The main impetus for de-dollarization in recent months stems from a rise in geopolitical tensions. The war in Ukraine has played a meaningful role in the escalation of these risks. The U.S. and its Western allies have retaliated against Russia with a number of sanctions since the war began. On the other hand, Russia’s traditional allies in the East have been conspicuously silent in their condemnation of its actions in Ukraine. This misalignment on the geopolitical front has led the BRICS bloc (Brazil, Russia, India, China and South Africa) to decouple from the U.S.

We highlight a number of catalysts that may sustain this trend to reduce global reliance on the dollar. Our discussion attempts to steer clear of any political ideology and focuses solely on the likely economic impact of actual or potential policy actions.

Preserving Monetary Sovereignty

The mere premise of trading a country’s basic goods and services in a foreign currency presents a certain level of risk to that country’s monetary sovereignty. The domestic economy now becomes more vulnerable to currency and inflation shocks as well as foreign monetary policy. This proved to be particularly true for Russia whose commodity exports are largely dollarized.

As the BRICS bloc increases its global impact and ramps up its strategic rivalry with the West, it is mindful of the need, and opportunities, to become more independent in an increasingly multipolar world.

Security of Currency Reserves

The immediate and punitive sanctions on Russia also highlighted the reach and influence of Western institutions on emerging market economies.

As an example, the freezing of Russia’s foreign exchange reserves held abroad impaired its central bank’s ability to support the ruble, fight domestic inflation and provide liquidity to the private sector as external funding dried up. The actions of the U.S. and its Western allies were a reminder of how the dollar, and other currencies, can get politically weaponized.

Russia had already started its de-dollarization in 2014 after the Crimean invasion. Russia’s central bank has since cut its share of dollar-denominated reserves by more than half. It has also announced plans to eliminate all dollar-denominated assets from its sovereign wealth fund.

Shifts in Trade Invoicing

The efforts to de-dollarize have been most intense in this area. China has been a key force behind this trend, especially after the onset of its trade war with the U.S. in 2018. In a major threat to petrodollar hegemony, China is currently negotiating with Saudi Arabia to settle oil trades in Chinese yuan. On a recent state visit to China, French President Macron announced yuan-denominated bilateral trade in shipbuilding and liquefied natural gas.

Russia has also been active in shifting away from the use of dollars in foreign trade. It has steadily reduced its share of dollar settlements from 80% to 50% in the last ten years. India has been paying for deeply discounted Russian oil with Indian rupees for several months. India has also announced bilateral arrangements with several countries like Malaysia and Tanzania to settle trades in rupees. And in an unusual development, Pakistan recently paid for cheap Russian oil in Chinese yuan.

A desire on the part of the BRICS bloc to further extend membership to Iran and Saudi Arabia later in 2023 is another sign of petrodollar diversification and divestment.

Alternate Payment Systems

The lifeblood of international finance is its payment system. The gold standard for international money and security transfers is the Society for Worldwide Interbank Financial Telecommunications (SWIFT). SWIFT does not actually move funds; it is instead a secure messaging system that allows banks to communicate quickly, efficiently and cheaply. China and Russia are now building international payment systems that can actually clear and settle cross-border transactions in their currencies.

These new trends will play a meaningful role in the eventual increased polarity of the currency world.

Reserve Currency Alternatives

We have already highlighted strong economic growth and institutional governance as important factors for ascendancy in global currency markets. The dollar has benefitted from those attributes among others for several decades now.

As the chatter on de-dollarization picks up, we take a quick look at how viable other currencies are to replace the dollar as the world’s reserve currency. We examine the current mix of global currency reserves to identify some candidates.

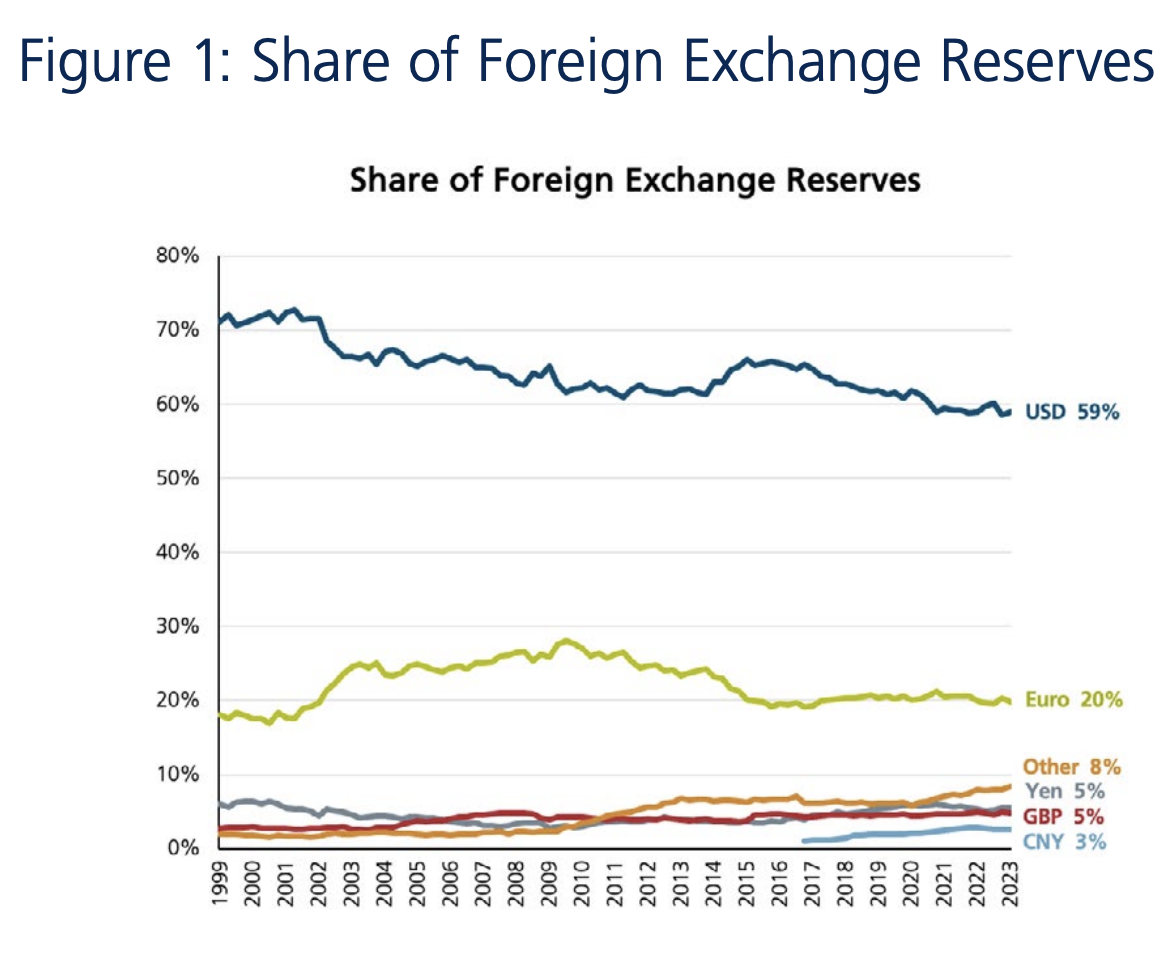

Figure 1 shows the composition of central bank reserves over time. Even with the steady decline in the dollar’s share this century, it is still almost three times as large as the second-largest currency in foreign exchange reserves.

Source: International Monetary Fund (IMF) COFER. As of Q1 2023, share is % of allocated reserves

The euro is the second largest currency within global central bank reserves with a share of around 20%. The share of other currencies tapers off rapidly thereafter with the Japanese yen and the British pound at 5% apiece and the Chinese yuan at 3%.

The broad-based malaise in their local economies and markets work against both the U.K. and Japan. The U.K. is adrift and directionless post-Brexit, and the pound has been in a steady decline for many years. The Japanese economy has been in the doldrums for several years now. The Japanese stock market peaked more than 30 years ago, and the Japanese yen is heavily influenced by the Bank of Japan. We rule out the pound and the yen as viable alternatives to the dollar.

This leaves us with three potential alternatives for the next reserve currency of the world.

- Euro

- Chinese yuan

- Basket of multiple currencies

We defer a discussion on central bank digital currencies to a later date based on their sheer nascence and lack of practicality. We also exclude monetary gold, which is not part of the foreign exchange reserves reported by the IMF.

Euro

The euro is the official currency of 20 out of the 27 members of the European Union. This currency union is commonly referred to as the Eurozone. The euro has a number of advantages that make it a viable contender for a more prominent role in the global currency market.

The Eurozone is one of the largest economic blocs in the world. It is also a major player in global trade. The euro is the second-largest currency today within each of the categories of global reserves, foreign exchange transactions and global debt outstanding. It is easily convertible and is supported by generally sound macroeconomic policies.

However, we highlight a couple of key disadvantages that may impede its rise to the status of the world’s reserve currency.

Fragmentation Risks – While the Eurozone has successfully maintained its currency union for more than 20 years, it still remains fragmented in a couple of key areas. The Eurozone does not have a common sovereign bond market and also lacks fiscal integration within the region. This heterogeneity disadvantages the euro in ways that simply do not affect the dollar; the stability of the dollar is reliant on one single central bank and one single central government.

We illustrate this with a simple example. The divergence in bond yields and national fiscal policies was at the heart of the Eurozone sovereign debt crisis around 2010. Several countries such as Greece, Portugal, Ireland and Spain were unable to repay or refinance their own government debt or help their own troubled banks. The bailout from other Eurozone countries required a level of fiscal austerity in terms of spending limits that proved politically challenging to implement. The euro came under considerable selling pressure at that time, which also saw a decline in its share of global foreign exchange reserves.

Lack of Political Diversification – The Eurozone is politically aligned with the U.S. on many geopolitical topics. Their unity came to the fore again during the imposition of Russian sanctions. If the main impetus to de-dollarize comes from the goal of political diversification in reserve holdings, the euro is not much of a substitute to the dollar in that regard.

Chinese Yuan

China has the second largest economy in the world and is invariably one of the top trading partners for many countries. In light of this, it may seem surprising that the yuan’s share of global trade invoicing is low at around 5%, and its share of global currency reserves is even smaller at around 3%.

While the Chinese yuan may aspire to play a bigger role in world currency markets, there are a number of hurdles that it may be unable or unwilling to overcome.

Lack of Convertibility and Liquidity – The Chinese yuan is not freely traded; it is pegged to the dollar and cannot be easily converted into other currencies or foreign assets.

Capital Controls – China imposes restrictions on the outflow of both capital and currency. It does so to limit the drawdown of its foreign exchange reserves and to keep the value of the yuan stable.

There has been a stark divergence between global and Chinese monetary policies in recent months. Global central banks have tightened aggressively to fight inflation; China has been reluctant to do so to protect its still-fragile, post-Covid recovery. This divergence in rates has exerted downward pressure on the yuan. China does not wish to deplete its foreign currency reserves by buying yuan. It also doesn’t want to see the yuan weaken further. Capital controls are the only way for it to achieve both goals.

Inherent Incompatibility – China enjoys a significant cost and competitive advantage in global markets through a relatively weak currency. The more it exports, the greater its incentive to limit currency appreciation. If the yuan succeeds in becoming the world’s reserve currency, the resulting demand for yuan will cause it to appreciate. In a perverse feedback loop, a stronger yuan will make China less competitive in global markets. This inherent incompatibility creates a strong disincentive for the yuan to overtake the dollar.

Basket of Currencies

It has also been proposed that a basket of currencies be designated to fulfill the role of a reserve currency. Any combination of currencies will have similar fragmentation risks to those listed above for the euro. In addition, hedging costs will be higher for a reserve currency basket because of asset-liability mismatches and liquidity differentials across constituent currencies.

A G-7 basket of currencies with high political solidarity will suffer from the same limitations in terms of lack of political diversification. On the other hand, a BRICS or any other Emerging Markets (EM) reserve currency basket will suffer from familiar issues of misalignment of common interests, lack of market depth, risk of political intervention and inherent incompatibility in balancing export competitiveness with currency strength.

We are, however, intrigued by the growing role of smaller currencies such as the Australian and Canadian dollars, the Swedish krona and the South Korean won within central bank reserves. In fact, these currencies account for more than two-thirds of the shift away from the U.S. dollar in recent years. We expect that their virtues of higher returns, lower volatility and fin-tech innovation will help them further increase their share in global reserves.

We come full circle and close out our discussion by highlighting the numerous advantages of the U.S. dollar in the global currency markets.

Fundamental Dollar Advantages

Even as its hegemony diminishes at the margin, we believe that the dollar will remain the world’s reserve currency for several decades. Our optimism is based on both the limitations of competing alternatives and the significant fundamental advantages of the dollar.

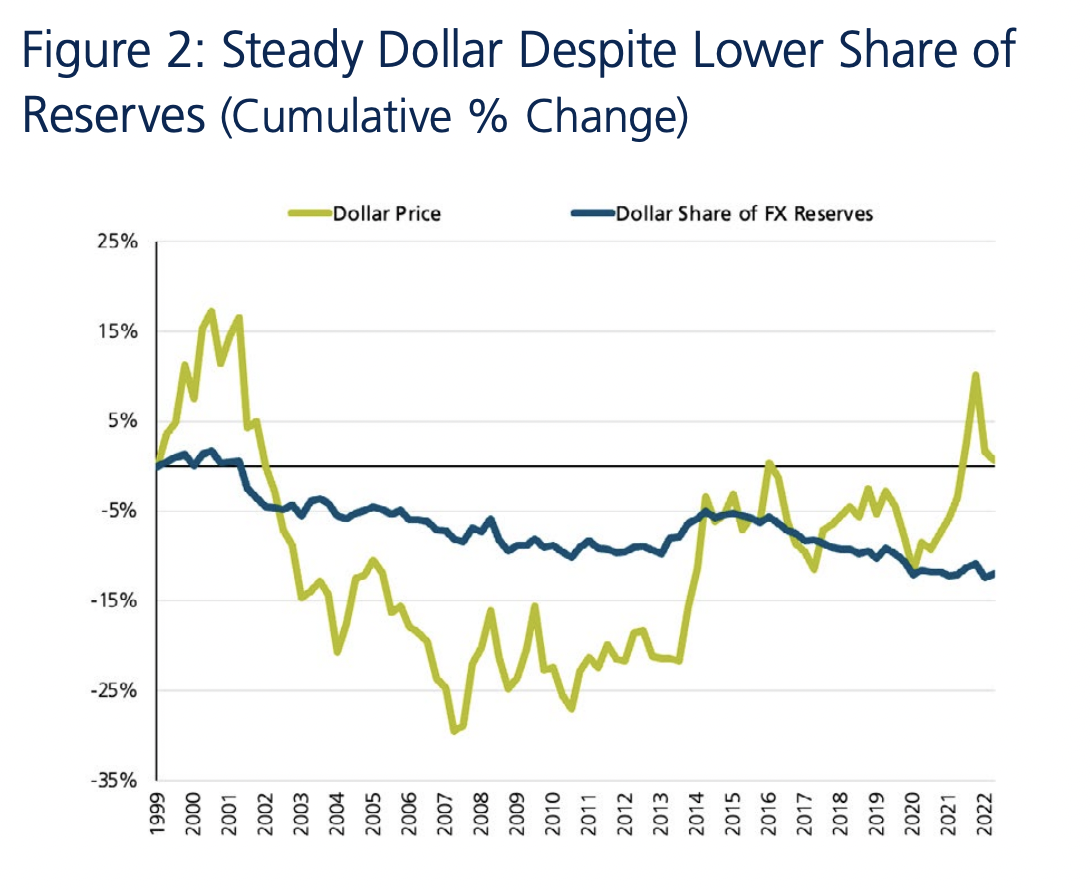

It is actually remarkable that the dollar has remained steady even in the face of lower demand from a declining share of foreign exchange reserves. We see this divergence in Figure 2.

Source: IMF COFER. As of Q1 2023, share is % of allocated reserves, dollar price is for DXY trade-weighted dollar

Source: IMF COFER. As of Q1 2023, share is % of allocated reserves, dollar price is for DXY trade-weighted dollar

The green line in Figure 2 represents the price stability of the dollar even as its share of reserves fell from 1999 to 2022.

We turn to basic currency fundamentals to explain this steady historical performance and also to argue in favor of the dollar going forward. In the long term, currency performance is determined by differentials in inflation, economic growth, real income and productivity gains. The U.S. offers significant advantages on these and many other fronts.

- Strong economic growth and incomes driven by sound macroeconomic policies

- Low inflation from independent and credible monetary policy

- Technological innovation that contributes to both productivity growth and disinflation

- High domestic consumption which reduces reliance on trade and currency effects

- Convertibility, stability and liquidity of the dollar

- Deep and liquid bond market

- Fundamental attractiveness of U.S. risk assets such as stocks, real estate and private investments

- Well-regulated capital markets

- Government and institutional adherence to the rule of law

- Strong and credible military presence

We do not see a credible threat to the dollar’s status as the world’s reserve currency in the foreseeable future.

Summary

We expect dollar hegemony to be preserved, and only modestly diminished, over the next several years. The following trends summarize our outlook for the composition of central bank reserves and the currency markets overall.

a. The dollar’s share of world reserves will continue to decline gradually but still remain above 50%.

b. The share of the euro, Australian dollar, Canadian dollar, Swedish krona, Swiss franc and South Korean won will inch higher.

c. The share of the Chinese yuan and other BRICS / EM currencies will rise less than what is currently expected.

We chose to focus exclusively on the current dedollarization debate in this quarter’s publication. At the same time, we are well aware of the deeply divided views on inflation, recession and the stock and bond markets. We are also closely watching the progression of any credit crunch from the March banking crisis.

In the brief space here at the end, we will simply observe that we are more constructive on the economy and markets than the worst-case scenarios. Our pro-growth positioning in portfolios has paid off handsomely so far in 2023. We remain careful and vigilant during these uncertain times.

The main impetus for de-dollarization in recent months stems from a rise in geopolitical tensions.

We expect dollar hegemony to be preserved, and only modestly diminished, for the next several years.

Our optimism is based on both the limitations of competing alternatives and the fundamental advantages of the dollar.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.

Source: IMF COFER. As of Q1 2023, share is % of allocated reserves, dollar price is for DXY trade-weighted dollar

Source: IMF COFER. As of Q1 2023, share is % of allocated reserves, dollar price is for DXY trade-weighted dollar