Navigating deferral of gain on QSBS

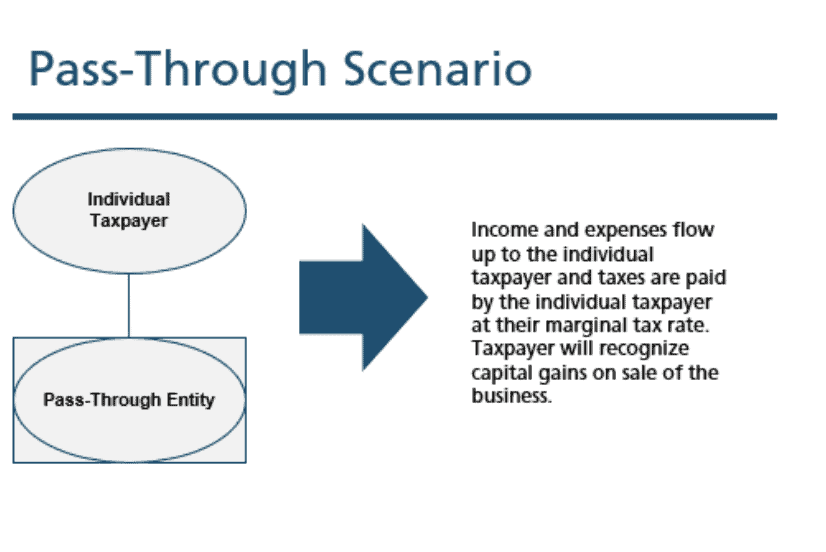

When you’re growing a legacy, it’s only natural to want to preserve as much of your hard-earned wealth as possible. From exploring the best investment options to the tax efficient funds that suit your overall goals and much more, prudent financial advisors make it a priority to consider any and all options for their clients. For those who own their own businesses, corporate tax structure is of particular interest.

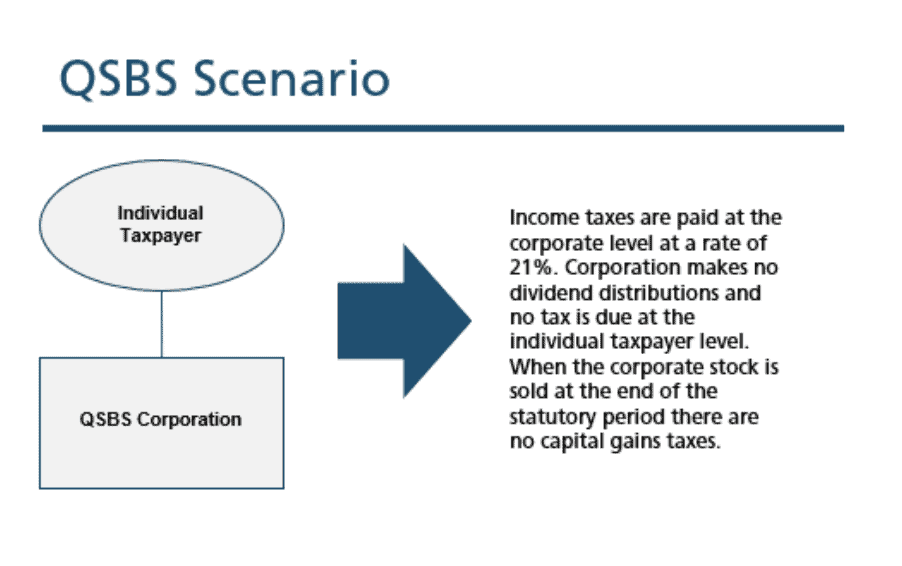

Case in point: one side-effect of the 2017 Tax Cuts and Jobs Act (TCJA) was the renewed interest in Qualified Small Business Stock (QSBS). “With the corporate tax rate reduced from 35% to 21%, business founders, investors, private equity groups and hedge funds have increasingly turned to QSBS as a way to save millions in taxes,” says Client Advisory and Tax Vice President at Whittier Trust Charles Horn, who looks to maximize wealth retention and growth for his clients.

QSBS is codified in IRC section 1202 and was originally published in 1993 to encourage investment in emerging companies by providing income tax incentives to holders of such stock. QSBS can only be issued by a C-Corporation with a market cap equal to or less than $50M. The tax exclusion for each issuer of QSBS is the greater of $10M or 10 times the adjusted basis. For a corporation with an adjusted basis of $50M at the time of issuance, the tax exclusion could be as high as $500M. This could be a huge win for a small business owner.

One important requirement of IRC section 1202 is that the stock must be held for more than five years from date of issuance. The general rule is that the five-year holding period begins when the stock is issued. “We’ve been asked to assist clients where QSBS stock held by a trust has not yet reached the five-year holding period and the underlying C-Corporation is being dissolved. Clients often wonder what if anything can be done in such an instance,” says Horn. “The answer is yes, so long as the stock has been held for at least six months.” This is where IRC section 1045 steps in.

IRC section 1045 allows a taxpayer to defer recognition of gain on the sale of QSBS if replacement stock is purchased within 60 days beginning on the date of sale. “In other words, so long as a taxpayer can identify a replacement QSBS stock within 60 days of the dissolution of the previous QSBS stock, the exclusion can still apply,” Horn explains.

In fact, IRC section 1045 is more generous than IRC section 1031, which governs like-kind exchanges of real property. Under IRC section 1031, cash received from the sale of real property must be held by a qualified intermediary (“QI”) and cannot touch the hands of the taxpayer for one moment during the transaction. IRC section 1045 has no tracing restriction. “In fact, one could receive the funds from the sale of QSBS, use those funds for some other need, and use replacement funds to purchase new QSBS within 60 days and the rollover remains intact,” says Horn.

The primary restrictions are that the taxpayer must reinvest the entire sales proceeds (not just gain) in replacement QSBS or gain recognition will be required and the replacement QSBS must meet the qualified trade or business requirement for at least 6 months after the taxpayer’s acquisition. Taxpayers must also make an election of deferral on a timely filed tax return for the year of sale.

In fact, even where newly acquired QSBS later fails the requirements of IRC section 1202 resulting in the recognition of capital gains, the deferral mechanism of IRC section 1045 will still apply. In other words, the deferral of tax under the IRC section 1045 remains intact even if a taxpayer is eventually forced to recognize gain. “IRC 1045 is a powerful tool and safety net for investors looking to take advantage of IRC 1202,” says Horn, who notes that taxpayers should consult their tax attorney or CPA with any questions.