In investing, “value” is a word that’s used often but rarely understood in depth. It is not just a price tag, an item on a balance sheet, or a line on a chart. Rather, value is a complex blend of trust, expectation, and the interplay between certainty and speculation. The recent surge in gold prices to record highs—driven by central banks seeking safe havens and investors responding to global uncertainty—has reignited a timeless question: What is something truly worth?

In investing, “value” is a word that’s used often but rarely understood in depth. It is not just a price tag, an item on a balance sheet, or a line on a chart. Rather, value is a complex blend of trust, expectation, and the interplay between certainty and speculation. The recent surge in gold prices to record highs—driven by central banks seeking safe havens and investors responding to global uncertainty—has reignited a timeless question: What is something truly worth?

As a result, we’re sharing more about the logic of value across asset classes, moving from the most predictable to the most speculative, and revealing how different forms of value are calculated, perceived, and ultimately believed.

Bonds: The Arithmetic of Certainty

Bonds are the bedrock of financial predictability. These instruments are essentially contracts: You lend money, receive regular interest, and—assuming no default—get your principal back at maturity. Their valuation is rooted in arithmetic:

- Present Value of Future Cash Flows: Each coupon payment and the return of principal are discounted to today’s value using prevailing interest rates.

- Yield to Maturity (YTM): This is the expected rate of return if the bond is held to maturity.

- Credit Spreads: Non-government bonds require higher yields to compensate for additional credit risk.

While factors like inflation, interest rate changes, and shifts in creditworthiness add complexity, bonds remain anchored in accountability and well-defined terms. They represent the closest thing to certainty in the investment world.

Real Estate: Tangible and Local

Real estate offers visibility and utility. Properties can provide income through rent and often appreciate over time. Valuation in real estate relies on several methods:

- Comparable Sales (Comps): What have similar properties sold for in the area?

- Income Approach (Cap Rate): Calculated as Net Operating Income divided by Property Value, this method is key for income-producing properties.

- Replacement Cost: What would it cost to rebuild the property today?

Real estate is about more than numbers; it’s about neighborhoods, tenants, and local narratives. While the fundamentals are solid, they are never static. Location can create value, while a poor tenant can erode it. The reverse is also true. The asset’s tangibility and the potential for steady cash flows make real estate a unique blend of predictability and variability.

Stocks: Ownership with Imagination

Owning a stock means holding a claim on a company’s future earnings, decisions, and relevance. Unlike bonds or real estate, stocks are inherently forward-looking and subject to interpretation. Key valuation methods include:

- Discounted Cash Flow (DCF): Projecting a company’s future cash flows and discounting them to present value based on risk and time horizon.

- Sum of the Parts (SOTP): Valuing each underlying business or asset separately to determine the overall worth.

- Earnings Multiples and Dividend Models: Using metrics like price-to-earnings ratios or dividend discount models to gauge value.

Stock prices swing on earnings reports, macroeconomic shifts, and geopolitical events. Yet, in the long run, fundamentals—such as earnings growth—tend to prevail. Successful investors are those who can distinguish signal from noise and think in years rather than days.

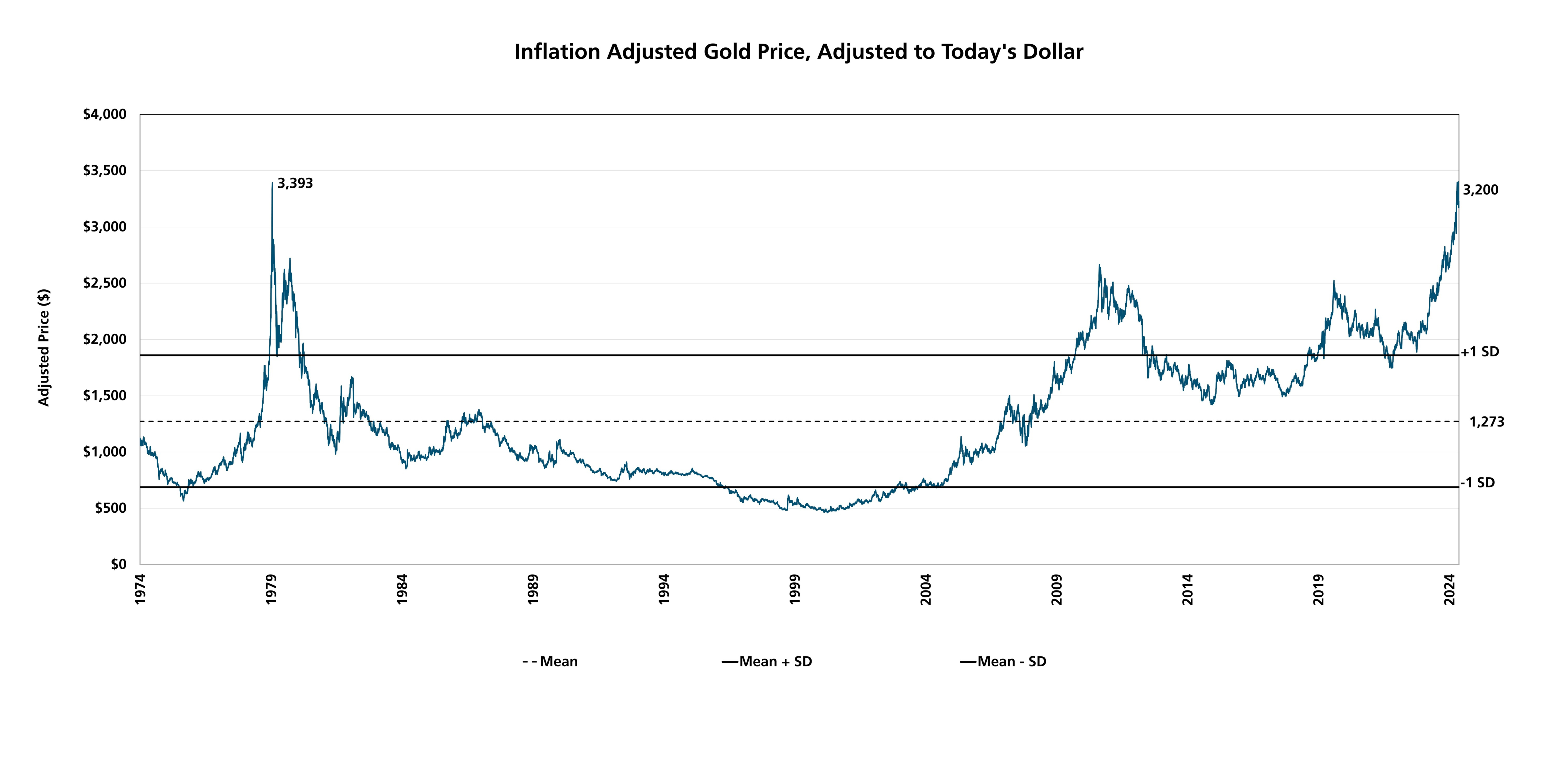

Gold and Precious Metals: The Value of Belief

Gold sits at the far end of the valuation spectrum. It generates no income and pays no dividends, yet it endures as a store of wealth. Its value is driven by:

- Scarcity: Mining is slow and costly, and supply is limited by nature.

- Macroeconomic Trends: Inflation, currency debasement, and global uncertainty boost demand.

- Market Psychology: In times of turmoil, investors seek gold for safety, not returns.

Recent years have seen gold prices soar to historic highs, with forecasts for 2025 ranging from $3,000 to nearly $3,700 per ounce as central banks and investors seek protection from economic and geopolitical risks. Unlike other assets, gold’s value is almost entirely a matter of belief—that is, confidence that others will continue to see it as a safe haven when other systems falter. In this sense, gold is as much about philosophy as it is about finance.

Value, Reconsidered

Tracing the arc from bonds to gold is a journey from definition to interpretation—from contractual returns to collective belief. Each step reveals not just how we price assets, but how we understand risk, reward, and resilience.

Warren Buffett famously said, “Price is what you pay. Value is what you get.” But what you get depends on how well you understand what lies beneath the numbers. In a world obsessed with immediacy, the ability to think in fundamentals-across asset classes and through market cycles-is a quiet but powerful advantage.

Ultimately, value is not just a calculation. It is a reflection of human judgment, emotion, and conviction—qualities that no formula can fully capture. At Whittier Trust, we understand value, both in the mechanics of strategically selecting assets that make sense based on our clients’ present needs and future legacy goals, but we also make it our business to understand each client’s underlying concerns.

Written by Caleb Silsby, Executive Vice President, Chief Portfolio Officer at Whittier Trust. Caleb oversees a team that collaboratively manages portfolios for high-net-worth clients, foundations, and endowments. He is credentialed as a CFA Charterholder and CFP professional.

If you’re ready to explore how Whittier Trust’s tailored investment strategies can work for you, start a conversation with a Whittier Trust advisor today by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.