Are you maximizing your after-tax returns to the fullest extent possible? This question holds immense weight for ultra-wealthy individuals as they navigate the complex landscape of taxation. Despite employing the expertise of traditional financial advisors and tax professionals, many find themselves falling short of truly optimizing their tax planning strategies. The seasoned wealth management advisors who make up the backbone of Whittier Trust’s family office services recognize the intricate challenges our clients face, and we pride ourselves on offering tailored solutions and tax planning services that are always geared to optimize their tax efficiency. Let’s delve into the role family office services can play in navigating the complexities of tax administration for ultra-wealthy individuals and families.

Benefits of Receiving Guidance and Administration from a Family Office

Family office services serve as the cornerstone of comprehensive wealth management for wealthy individuals and families. By entrusting their tax planning and administration to experienced advisors, clients gain access to a host of expertise tailored to their unique financial circumstances. Family offices develop a holistic tax plan considering the family's income, investments, trusts, and estate. This minimizes tax liabilities across estate, gift and income taxes, which includes pass-through, individual, corporate and fiduciary taxation. A family office can also act as your eyes and ears, constantly monitoring tax law changes and identifying opportunities to further optimize the family's tax situation. Our team of professionals possesses an in-depth understanding of tax laws, regulations, and industry trends, enabling us to devise customized tax planning strategies that align with our clients' long-term objectives while ensuring smooth day-to-day tax administration. We handle everything from filing returns and record keeping to expense tracking and payroll taxes. We also collaborate with external tax professionals for seamless compliance and accuracy.

Understanding the Complexity of Personal Taxes for the Ultra-Wealthy

Our clients operate within a landscape of multifaceted tax regulations and obligations. With diverse income sources–including investments, business ventures, and real estate holdings, many of which have been passed down intergenerationally–their tax liabilities extend far beyond the scope of conventional taxpayers. Here's how our advisors approach some of the most important considerations for our clients:

Multiple Jurisdictions:

We understand the complexities of managing assets and income across various locations, including both domestic (state and federal) and international jurisdictions. Each jurisdiction has its own unique tax laws, including income taxes, property taxes, and estate taxes, with varying rates and regulations. We help clients navigate these complexities to minimize tax burden and avoid double taxation. Our advisors can assist with navigating the nuances of multi-state taxation within the U.S. This includes understanding how state and federal income taxes interact, as well as property and estate tax implications across different states. For clients with international assets, it's crucial to remember that U.S. citizens and residents are taxed worldwide. We help navigate the intricacies of tax treaties, foreign tax regimes, and potential inheritance taxes impacting these assets. Our family office can coordinate with experienced tax professionals in both domestic and international jurisdictions. This ensures your assets are managed by experts with in-depth knowledge of the specific tax laws and applicable regulations. By understanding your unique circumstances and goals, our advisors can also provide insights on potential residency or asset location strategies that may enhance tax efficiency.

Non-Traditional Assets:

Investments in private equity, real estate, and alternative assets pose unique tax considerations. We help our clients value these assets for tax purposes and devise strategies to optimize their tax efficiency. When considering unique asset classes, our clients know that access to the best investing professionals and specialized tax advisors is crucial for performance. A multi-family office with a hybrid architecture is uniquely suited to managing such a team of experts.

Estate Taxes:

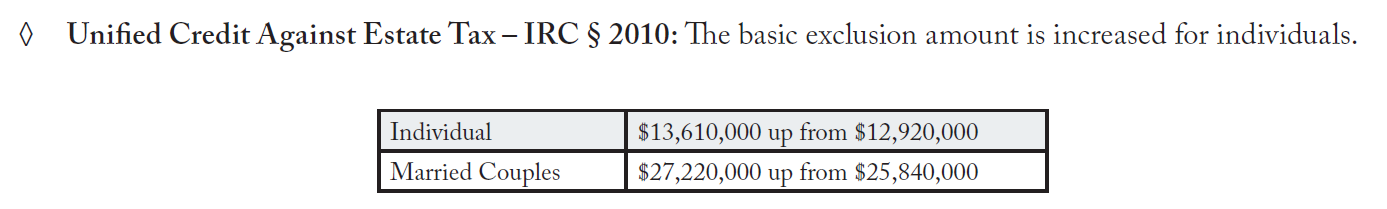

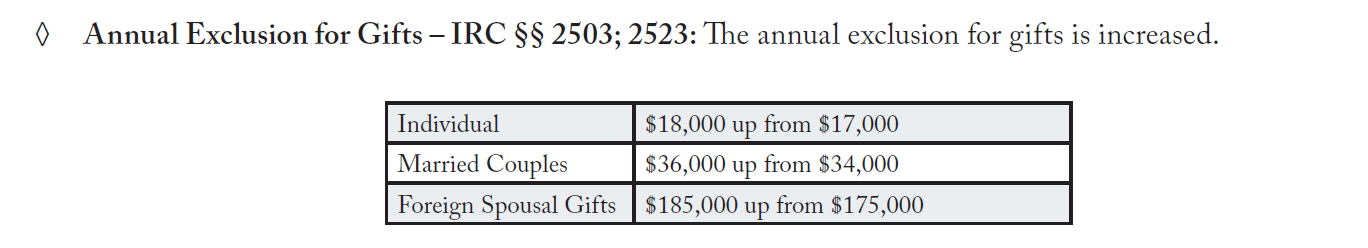

We provide comprehensive strategies to minimize estate tax burdens across generations, incorporating careful planning and knowledge of complex tax laws surrounding trusts, gifts, and inheritance. Strategic planners are already eyeing the crucial shift in estate tax exemption for 2025 and beyond, with the amount in 2026 slated to be half of the 2025 amount with an inflation adjustment. Past experiences, such as the panic-inducing sunset of the lifetime gift tax exemption in 2012, highlight the necessity for proactive planning with family offices to navigate impending changes, ensuring access to estate planning attorneys and informed decision-making.

Pass-through Entities:

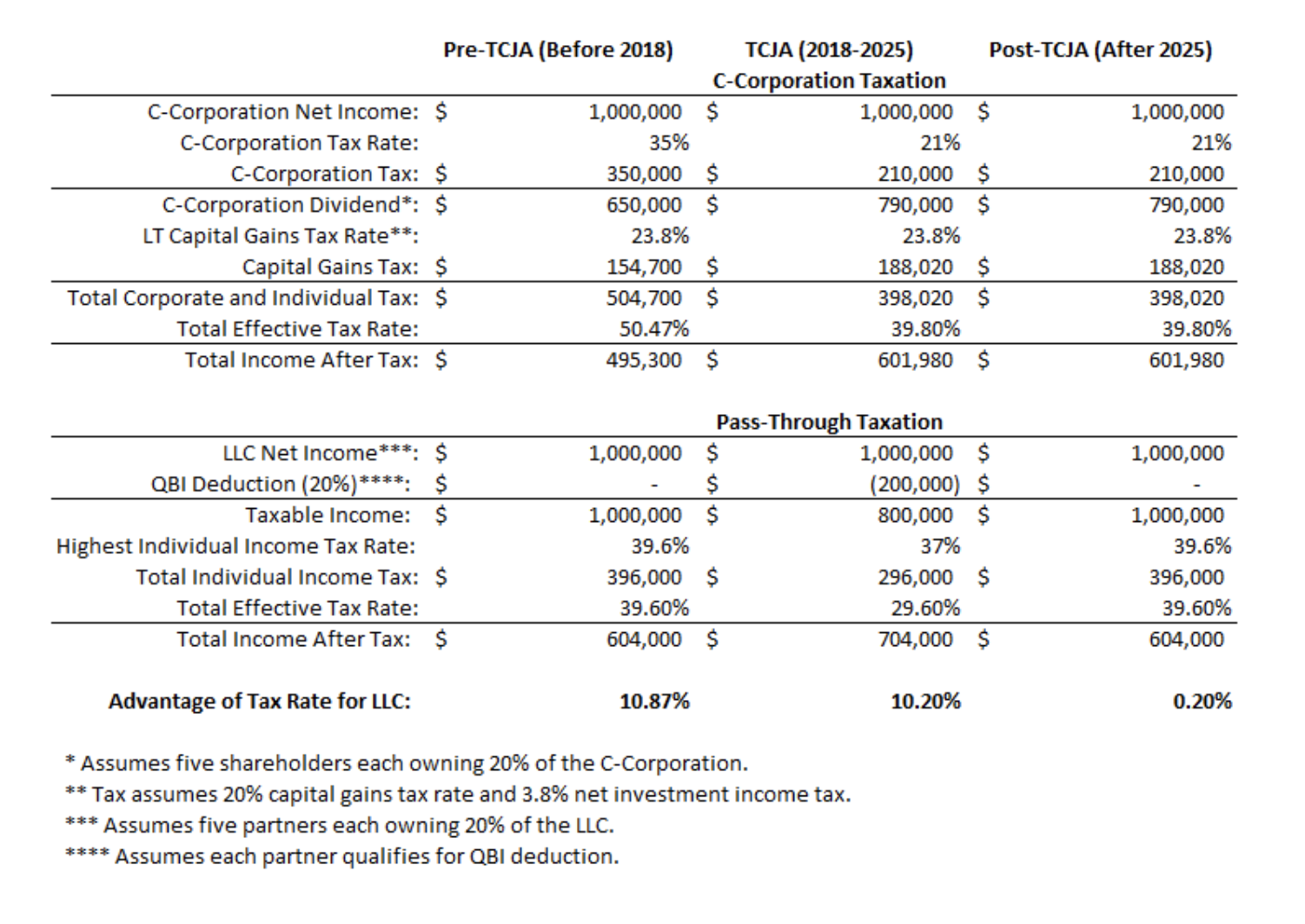

Many of our clients utilize complex structures like partnerships and LLCs for wealth management. Our advisors are well-versed in the tax implications and filing requirements associated with these entities, ensuring our clients remain compliant while maximizing tax benefits. Currently, our advisors are monitoring the impact of tax changes on pass-through entities, particularly regarding the Qualified Business Income (QBI) deduction under the TCJA. While pass-through entities initially had a tax advantage, the expiration of the QBI deduction and increased individual tax rates post-2026 diminish their appeal compared to C corporations, which are subject to a consistent 21% tax rate.

Charitable Giving:

Optimizing tax benefits from charitable contributions requires a deep understanding of foundation management. Our advisors assist clients in structuring their charitable giving to maximize tax advantages while aligning with their philanthropic goals and family values. Keeping the books for philanthropic efforts can often be a large undertaking. Our family office and philanthropic department ease this burden by handling quarterly and annual financial statements, issuing checks, and organizing necessary files for taxes and audits. We collaborate with the foundation’s CPA to facilitate tax preparation. For California-based private foundations or charitable trusts earning over $2 million annually, an audit is mandated the following year. This number can be challenging to track, so our advisors vigilantly monitor this threshold for our clients.

We understand that maintaining meticulous records and complying with complex reporting requirements can be burdensome for our clients. That's why we provide dedicated support and guidance throughout the process, ensuring effective management of these considerations while alleviating the administrative burden for individuals and families.

The Importance of Access to Tools and Techniques for Effective Tax Planning

Another boon to working with a family office is the access to sophisticated tools and increased exposure to industry-leading tax administrative and strategic techniques, which Whittier Trust advisors consistently update to ensure optimal tax efficiency. Our family office uses cloud-based tax software which facilitates secure and efficient management of tax and other data, enabling real-time collaboration and infallible storage. Advanced data processing and analytics tools help identify tax optimization opportunities and potential risks based on historical tax data and current strategies. Robust cybersecurity measures protect sensitive financial data, ensuring clients' peace of mind.

From income-shifting strategies to charitable giving, we employ diverse tactics to minimize tax liabilities while preserving wealth. We’re also always looking for new ways to optimize your assets with a long-term approach. With potential changes to the estate tax exemption looming, one of the levers we’ve been bullish on over the past few years are Grantor Retained Annuity Trusts (GRATs). GRATs have emerged as a strategic tool in tax planning thanks to their tax efficiency and flexibility, especially during periods characterized by high interest rates

Unlike conventional gifting methods, a GRAT facilitates the transfer of only the appreciation on trust assets, rendering it potentially gift and estate tax-free. This makes GRATs particularly appealing for individuals who have already maximized their lifetime gift tax exemptions or those uncertain about their utilization. Despite being an irrevocable trust, GRATs possess unique characteristics, such as the ability for the grantor to retain certain powers, including substituting trust assets, which enhance their flexibility. The success of a GRAT hinges on the assets' appreciation outpacing the annuity stream, especially vital in high-interest rate environments. Notably, a "rolling GRAT" strategy, comprising short-term GRATs funded by annuity payments from preceding ones, mitigates mortality and interest rate risks, exemplifying adaptability in tax planning.

Personalized & Comprehensive Guidance: The Cornerstone of Family Office Services

The complexities of tax administration for ultra-wealthy individuals and families necessitate a comprehensive approach grounded in expertise and personalized guidance. It’s important to engage with a family office committed to empowering you with the tools, strategies, and support you need to consistently adapt to, and proactively navigate, the intricate landscape of tax planning and administration successfully. By leveraging our extensive experience and resources, we enable our clients to achieve their financial objectives while minimizing tax liabilities and preserving wealth for future generations. It’s never the wrong time to ask yourself if your tax planning strategies are working for you.

_____________

If you’re curious about our family office and tax planning services and how they might ease the administrative burden on you and your family, we invite you to speak with one of our wealth management advisors by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.